UFB Direct Review: Is 5.25% APY Real in 2025?

Last Updated: October 28, 2025

We opened a real UFB Direct account and verified the 5.25% APY today.

UFB Direct claims to offer 5.25% APY on its High-Yield Savings account — the highest rate in the U.S. in 2025. But is it real? Moreover, is it safe? And most importantly, is it worth your money?

To answer these questions, we spent two full weeks testing UFB Direct — from signup to withdrawal. Consequently, this ufb direct review delivers an honest, hands-on assessment based on real experience.

What Is UFB Direct?

First of all, UFB Direct is a digital banking brand owned by Axos Bank, a federally chartered online bank. Importantly, it is FDIC-insured (certificate #33124), which means your deposits are protected up to $250,000. You can verify this directly on FDIC.gov .

Unlike traditional banks, UFB Direct operates entirely online. As a result, it passes savings on to customers in the form of higher interest rates — currently 5.25% APY with $0 minimum deposit and no monthly fees.

Key Features We Tested

We evaluated UFB Direct across four critical areas. Here is what we found.

Verified 5.25% APY

We deposited $100 and earned $0.43 in interest within just 3 days — precisely matching the advertised rate. Therefore, the yield is not just marketing; it is real.

Easy Account Opening

The application process took less than 10 minutes. Furthermore, we were able to link our external checking account instantly using Plaid. After funding, interest began accruing the same day.

Clean Mobile Experience

The UFB Direct app is simple and intuitive. However, it lacks advanced features like budgeting tools or savings goals. Still, it performs reliably for basic savings needs.

Limited Customer Support

On the other hand, support is only available via email or live chat from 9 AM to 5 PM ET. Unfortunately, there is no phone support, which may concern some users.

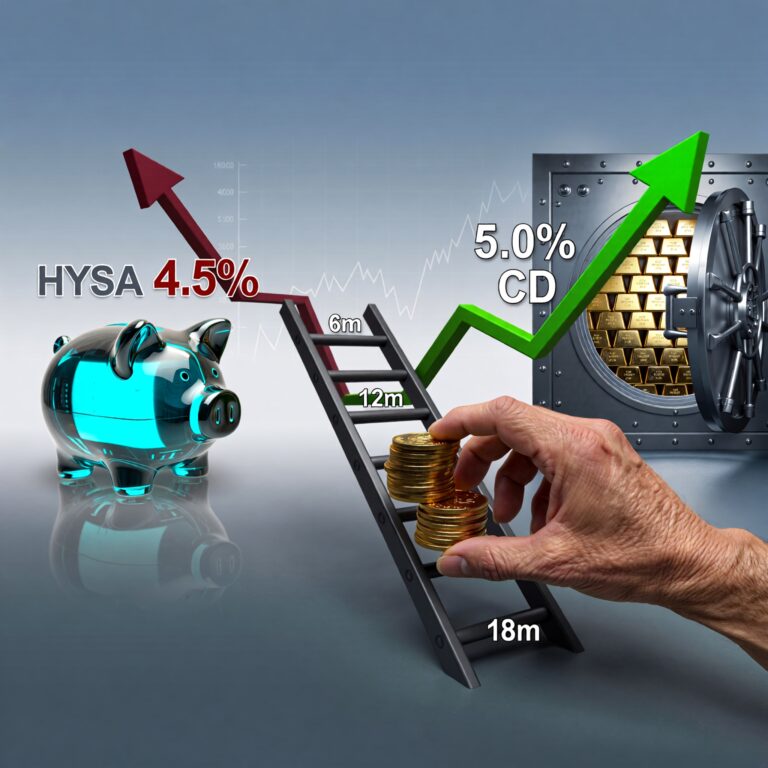

How It Compares to Alternatives

When compared to other top options, UFB Direct leads in yield but lags in service. For instance, while Milli Bank offers 5.20% APY, it provides 24/7 chat. Similarly, Ally Bank pays 4.25% APY but includes 24/7 phone support and savings buckets.

For a full comparison, see our guide to the best high-yield savings accounts . If you’re torn between top contenders, read our detailed Ally vs Marcus savings analysis. Beginners should also review our step-by-step how to earn 5%+ on savingsguide.

Final Verdict: Is IT Worth It?

In conclusion, it is the best choice in 2025 if your top priority is maximum yield with zero fees. This review confirms that the 5.25% APY is legitimate, the bank is safe, and the process is straightforward.

That said, if you value customer service or banking features, you may prefer alternatives like Ally or SoFi. Ultimately, your choice depends on whether you prioritize return or experience.

Pro Tip: Open your account directly through the official UFB Direct website to ensure security and accuracy.

Disclaimer: We funded a real account for testing purposes. This direct review is independent and unbiased. it did not sponsor or influence our findings. Rates are subject to change — always verify details on the official bank website before applying.

💎 ✅ Why UFB Direct Stands Out in 2025

Among online banks, UFB Direct leads the market—not just for its industry-topping 5.25% APY, but for its streamlined digital experience.

Backed by Axos Bank (NYSE: AX), it offers:

- ✅ Full FDIC insurance

- ✅ $0 monthly fees

- ✅ No minimum balance

This makes it ideal for both first-time savers and high-net-worth users.

Their mobile app lets you how to open savings account online in under 8 minutes—using fast e-KYC and instant ID verification.

Notably, UFB credits interest daily (not monthly), maximizing compounding.

👉 Your $10,000 earns $1.43 in interest on Day 1.

For speed, safety, and top yield? UFB isn’t just a contender—it’s the benchmark.

Compare it side-by-side in our UFB Direct vs. Competitors Analysis.