Yield to Maturity (YTM): The Ultimate Guide for Smart Bond Investors

Published on YieldOom – Your Trusted Source for Fixed-Income Insights

Last Updated: December 22, 2025

When evaluating bonds and fixed-income securities, savvy investors look beyond coupon rates and current prices. One of the most critical metrics to assess a bond’s true return potential is Yield to Maturity (YTM). At our site, we break down this essential concept in simple, actionable terms—so you can make better-informed investment decisions.

What Is YTM ?

(YTM) is the total annualized return an investor can expect if they hold a bond until it matures—assuming all coupon payments are reinvested at the same rate and the issuer makes all payments on time. Unlike the nominal (coupon), total return accounts for:

The bond’s current market price

Its face (par) value

Coupon rate and payment frequency

Time remaining until maturity

In essence, total return is the bond’s internal rate of return (IRR)—a comprehensive measure of expected profitability.

Why YTM Matters More Than Coupon Rate

Many investors mistakenly equate a bond’s coupon rate with its actual return. But if you buy a bond at a discount (below par), your effective yield rises. Conversely, purchasing at a premium (above par) reduces your real return—even if the coupon looks attractive.

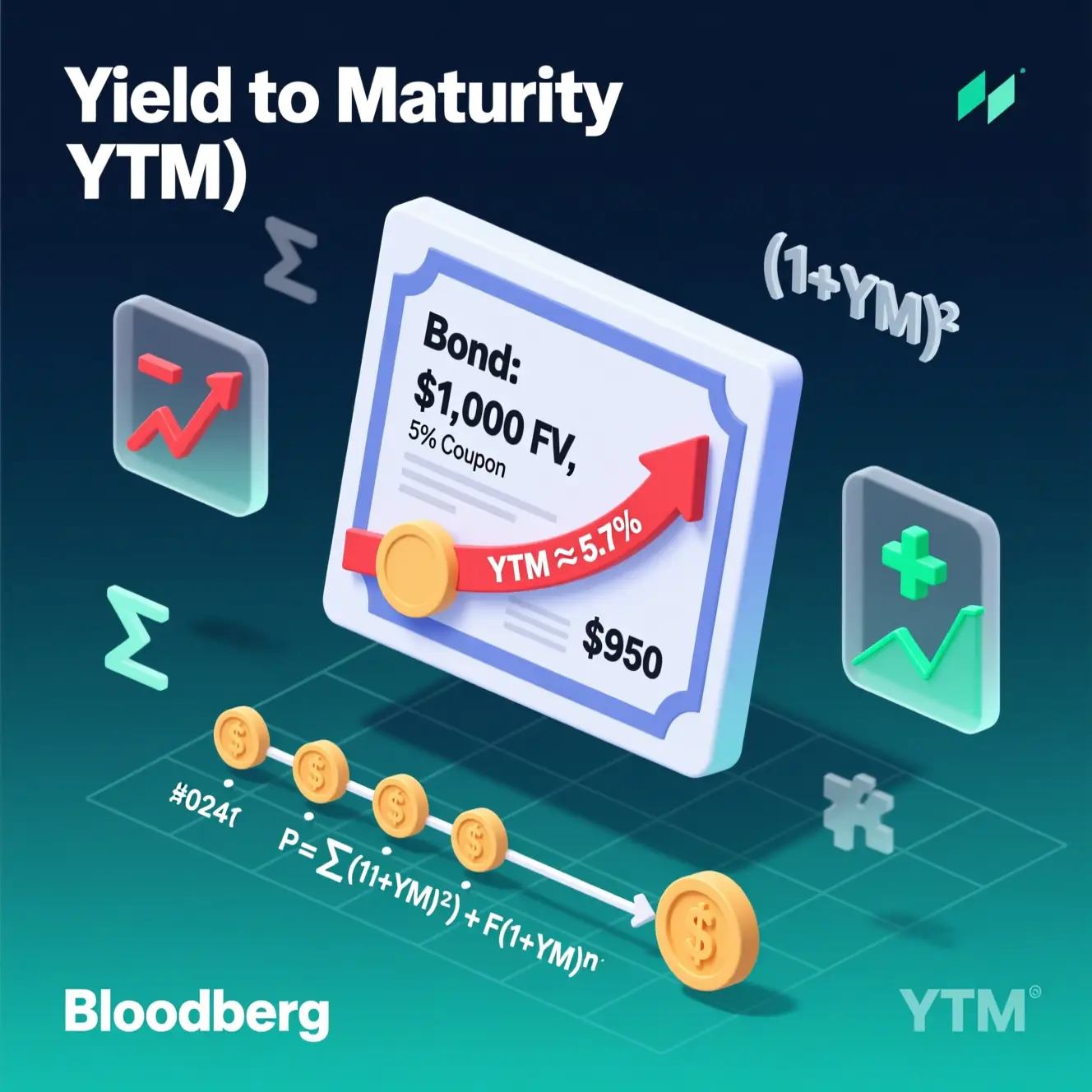

Example:

A 10-year bond with a $1,000 par value and a 5% annual coupon ($50/year) is trading at $950

Coupon Yield = $50 / $1,000 = 5%

Current Yield = $50 / $950 ≈ 5.26%

YTM ≈ 5.7% (after factoring in the $50 capital gain at maturity and time value)

This illustrates why bond yield is the gold standard for comparing bonds with different prices, maturities, and coupon structures.

How Is YTM Calculated?

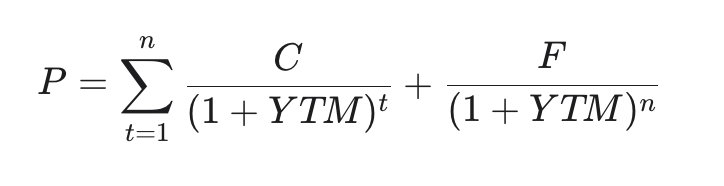

YTM isn’t solvable with a simple formula—it requires iterative calculation or financial tools because it discounts all future cash flows (coupons + principal) to equal the bond’s current price.

The underlying equation is:

Where:

P = Current market price

C = Periodic coupon payment

F = Face value

n = Number of periods to maturity

YTM = Yield to maturity (solved iteratively)

✅ Pro Tip: Use YieldOom’s free YTM Calculator for instant, accurate results—no spreadsheets needed!

Key Factors That Influence YTM

Market Interest Rates: When rates rise, existing bond prices fall—pushing YTM higher (and vice versa).

Credit Risk: Lower-rated bonds typically offer higher YTM to compensate for default risk.

Time to Maturity: Longer-dated bonds often have higher YTM due to increased uncertainty.

Callability & Embedded Options: Callable bonds may have Yield to Call (YTC) lower than YTM—if the issuer redeems early.

⚠️ Important Caveat: YTM assumes no default and reinvestment at the same rate—conditions rarely met in volatile markets.

YTM vs. Other’s Measures

| Measure | Definition | Limitation |

|---|---|---|

| Coupon Yield | Annual coupon ÷ Face value | Ignores price & maturity |

| Current Yield | Annual coupon ÷ Market price | Excludes capital gains/losses |

| (YTM) | Total return if held to maturity | Assumes reinvestment & no default |

| (YTC) | Return if bond is called early | Only relevant for callable bonds |

For serious bond analysis, YTM is the benchmark—but always pair it with credit analysis and macroeconomic context.

Real-World Application: Building a Bond Ladder

Fixed-income portfolios often use bond laddering—buying bonds with staggered maturities. YTM helps optimize this strategy:

Compare YTMs across maturities to identify the steepest yield curve segments

Balance risk: Higher YTM may mean lower credit quality or longer duration

Rebalance annually to capture rising rate environments

At YieldOom, our Bond Screener lets you filter by YTM, duration, rating, and sector—so you build smarter ladders, faster.

Final Thoughts: YTM Is a Tool, Not a Guarantee

While YTM is indispensable for bond valuation, remember:

🔹 It’s a forward-looking estimate, not a promise.

🔹 Reinvestment risk and inflation can erode real returns.

🔹 Always assess issuer fundamentals—A high YTM on a junk bond isn’t “better” if default risk is elevated.

Stay ahead with YieldOom’s weekly YTM insights, market alerts, and expert commentary. Subscribe to our newsletter and never miss an opportunity in the fixed-income space.