Retiring With Too Much Money? How to Manage a Retirement Surplus in 2025

What if the biggest challenge in your retirement wasn’t making ends meet—but figuring out what to do with the abundance? While most financial advice focuses on the fear of running out of money, a growing number of disciplined savers are facing the opposite: Retiring with “too much” money.

Far from being a mistake, a retirement surplus is the ultimate sign of financial security. According to a 2024 Vanguard study, 23% of retirees spend less than 3% of their portfolio annually, allowing their wealth to grow well into their 80s.

In this guide, we explore how to turn financial abundance into a purposeful legacy using the latest 2025 safe withdrawal rates and tax optimization strategies.

Why a Retirement Surplus is Your Ultimate Safety Net

Many fear “over-saving” is a waste of time. However, in today’s volatile economy, “too much” money provides:

- Longevity Insurance: Shields you if you live to 95 or beyond.

- Market Resilience: Protects your lifestyle during a “lost decade” in the stock market.

- Flexibility: Enables you to fund “bucket list” travel or emergency family needs without guilt.

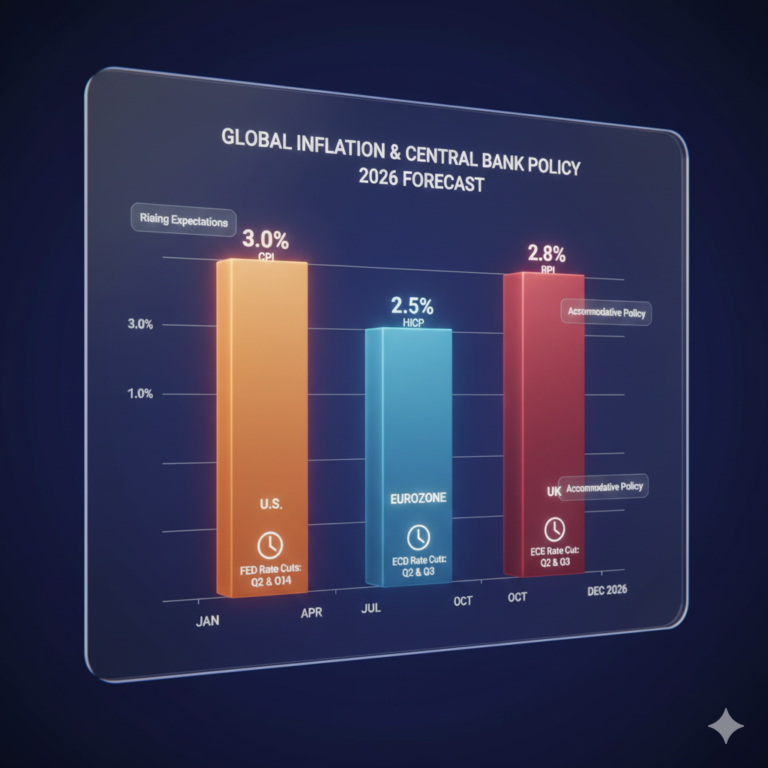

Step 1: The New “Safe Withdrawal Rate” for 2025

The old 4% rule is evolving. In 2025, market valuations and interest rate shifts suggest a more nuanced approach.

The 3.9% Benchmark

Morningstar’s 2025 research suggests 3.9% as the peak safe starting rate for a 30-year horizon. However, if you have a surplus, you can utilize a Dynamic Spending Strategy:

- The Floor: Withdraw 2.5% for essential needs.

- The Ceiling: Withdraw up to 5% during bull markets for luxury spending or gifting.

| Strategy | Withdrawal Rate | Best For |

| Safety-First | 2.5% – 3.0% | Ultra-long retirement (40+ years) |

| Morningstar Base | 3.9% | Standard 30-year horizon |

| Dynamic Ceiling | 5.0% + | High-surplus portfolios in up-markets |

Export to Sheets

Step 2: Portfolio Growth vs. Preservation

If you have more than you need, you shouldn’t just “hide” in bonds. Inflation is the silent killer of stagnant wealth.

The “Rising Equity Glidepath”

Research by Pfau & Kitces shows that retirees with a surplus often benefit from starting at 50% equities and increasingthat exposure to 60-70% as they age. This preserves the “real” value of your legacy for heirs.

Step 3: Tax Optimization (The “Silent” Wealth Multiplier)

A large RMD (Required Minimum Distribution) at age 73 can push you into a higher tax bracket. If you have “too much” money, use these three shields:

- Roth Conversion Ladder: Move funds from a Traditional IRA to a Roth IRA between ages 60 and 72. You pay taxes now (at likely lower rates) to enjoy tax-free growth forever.

- Qualified Charitable Distributions (QCDs): After age 70½, you can send up to $105,000 (2025 limit) directly to a charity. This counts toward your RMD but isn’t taxed as income.

- Step-Up in Basis: Keep highly appreciated stocks in your taxable account. When you pass them to heirs, their “cost basis” resets to the current market value, potentially saving them millions in capital gains taxes.

Step 4: From Accumulation to Significance

“Too much money” only feels like a burden if it lacks a mission.

- Family 529 Plans: Super-fund your grandchildren’s education. In 2025, you can contribute up to $18,000/year (per person) without triggering gift taxes.

- Donor-Advised Funds (DAF): Take an immediate tax deduction today and grant the money to your favorite causes over the next 20 years.

- Encore Careers: Use your surplus to fund a passion project or non-profit without worrying about a paycheck.

Summary: The Risk of Playing it Too Safe

As financial analyst Carl Richards famously said: “Risk isn’t just losing money. It’s waking up at 80 and realizing you played it too safe.”

Retiring with too much money isn’t hoarding—it’s responsible stewardship. By using dynamic spending and tax-smart strategies, you ensure that your abundance serves your family and your community for generations.

What’s Next?

- Calculate Your Number: Use our Retirement Yield Calculator to see if you’re on track for a surplus.

- Get the Checklist: Download our 2025 Tax-Efficient Retirement Guide below.