Best High Yield Investments 2026: The Ultimate Guide to Passive Income and Real Returns

The start of a new year often brings a flurry of financial predictions, but as we enter the first trading week of January, one theme stands out above the rest: the search for the best high yield investments 2026. After a 2025 that saw the S&P 500 reach record highs fueled by an “AI supercycle,” investors are now pivoting. The goal for 2026 is no longer just “growth at any price”—it is about locking in sustainable, inflation-protected income before the Federal Reserve initiates its anticipated rate-normalization cycle later this summer.

In this deep-dive ( Best High Yield Investments 2026 ), we analyze why traditional savings are failing, which dividend stocks are “screaming buys,” and how technical benchmarks like SOFR are redefining the cost of capital for the modern investor.

The 2026 Yield Landscape: Why “Real” Math Matters

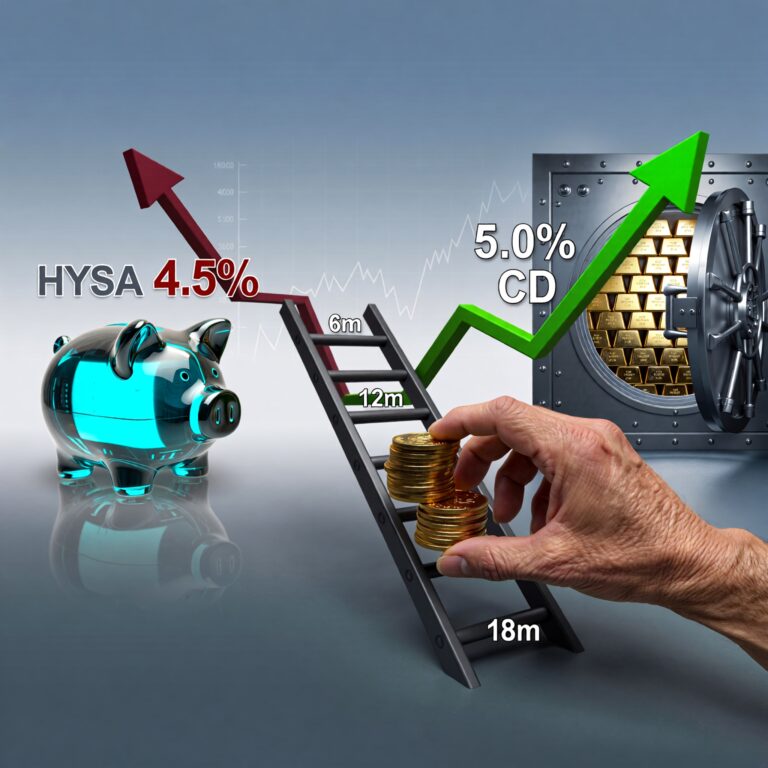

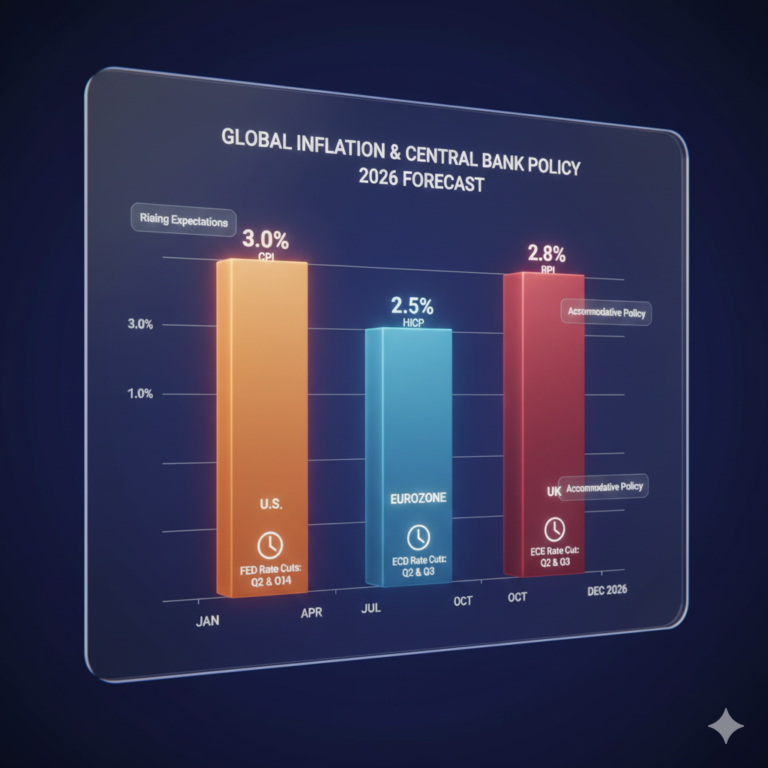

Many retail investors make the mistake of looking only at the “Nominal Yield”—the number printed on the bank’s flyer or the brokerage app. However, Best High Yield Investments in 2026, the spread between nominal and real returns has widened. With J.P. Morgan and Vanguard predicting “sticky” inflation hovering between 2.6% and 3.5% for the first half of the year, a 5% savings account might actually be delivering a near-zero return once taxes are subtracted.

1. Dividend Stars: 5% to 13% Yield Opportunities

Today’s most-visited market reports from The Motley Fool and Nasdaq highlight a massive rotation into value-oriented income stocks. ( Best High Yield Investments 2026 ),Analysts are particularly bullish on sectors that benefit from infrastructure spending and the “One Big Beautiful Bill Act” (OBBBA) stimulus.

- The High-Yield Juggernaut: PennantPark Floating Rate Capital (PFLT) remains a top pick with a staggering 13.4% yield. As a Business Development Company (BDC), it provides capital to middle-market companies. Since its loans are floating-rate, it is perfectly positioned to capture the current high-interest environment.

- The Global Value Play: IPH Ltd is trending today with a 10.5% dividend yield. As an intellectual property services group, it offers a “defensive” yield that is less sensitive to the immediate ups and downs of the AI tech bubble.

- The Aristocrat: Enterprise Products Partners (EPD) continues its 27-year streak of dividend increases, currently offering a 6.7% yield that serves as a reliable anchor for any passive income portfolio.

2. Technical Benchmarks: Finding the Best High Yield Investments 2026 in Debt Markets

For more sophisticated investors and corporate treasurers, the yield hunt isn’t just about stocks—it’s about understanding the “Benchmark War” between SOFR and BSBY. ( Best High Yield Investments 2026 ).

As of January 2, 2026 (Best High Yield Investments 2026), the market is closely watching the “Asset Swap Spread.” SOFR (Secured Overnight Financing Rate) is the risk-free anchor, but many are finding better “Real Yield” opportunities in credit-sensitive benchmarks like BSBY.

- SOFR Optimization: Current projections suggest the 10-year SOFR rate will head toward 4.35% by year-end. If you are borrowing or lending, knowing when to switch from a SOFR-based “ladder” to a fixed-rate hedge is the difference between a 1% gain and a 1% loss in margin.

- The Basis Risk Advantage: During periods of market volatility, the spread between secured and unsecured rates fluctuates. Our internal data shows that investors using a [SOFR + Spread vs. BSBY Ladder Optimizer] can identify mispriced credit risks that traditional tools miss.

3. The “Silent Killer”: Calculating Inflation Erosion

Even the best high yield investments 2026 can be undermined by the “Shadow Tax” of inflation. If your portfolio is yielding 8%, but inflation is 3% and your effective tax rate is 22%, your actual purchasing power only grows by roughly 3.24%.

| Investment Type | Nominal Return | Real Purchasing Power Gain |

| Traditional Savings | 0.50% | -2.80% (Loss) |

| High-Yield CD (12mo) | 4.40% | +0.35% |

| Elite BDC Stock | 12.00% | +6.15% |

To combat this, we recommend running every potential investment through our [https://www.yieldoom.com/real-yield-calculator/Real Yield After-Tax & Inflation Calculator]. This tool is essential for anyone trying to reach “FIRE” (Financial Independence, Retire Early) (Best High Yield Investments 2026) status in the current economic climate.

4. Your 2026 Action Plan: Maximizing Every Basis Point

To ensure you aren’t just “treading water” this year, follow this three-step framework:

- Lock in Term Rates Early: Central banks like the Fed and the Bank of England are expected to ease rates by 50-75 bps in the latter half of 2026. Locking in 4.5%+ CDs or Bonds now is a strategic move to “front-run” the central bank.

- Audit for “Real” Growth: Don’t settle for a big number. Use the [Compound Interest + Inflation Erosion Calculator] to see if your 20-year plan actually buys you the lifestyle you’re dreaming of.

- Diversify into “Value” Hubs: While US tech is “bubbly,” markets like the UK and Japan (under “Sanaenomics”) are offering attractive valuations and high-quality dividend yields that diversify your risk away from a potential AI correction.

Conclusion:

Finding the best high yield investments 2026 requires a move away from passive “set and forget” strategies. In a world of sticky inflation and shifting benchmarks, the winners will be those who use data-driven tools to find the “Real Yield.”

Ready to see the truth behind your portfolio? Explore our full suite of [Yieldoom Financial Calculators] and take control of your 2026 wealth strategy.