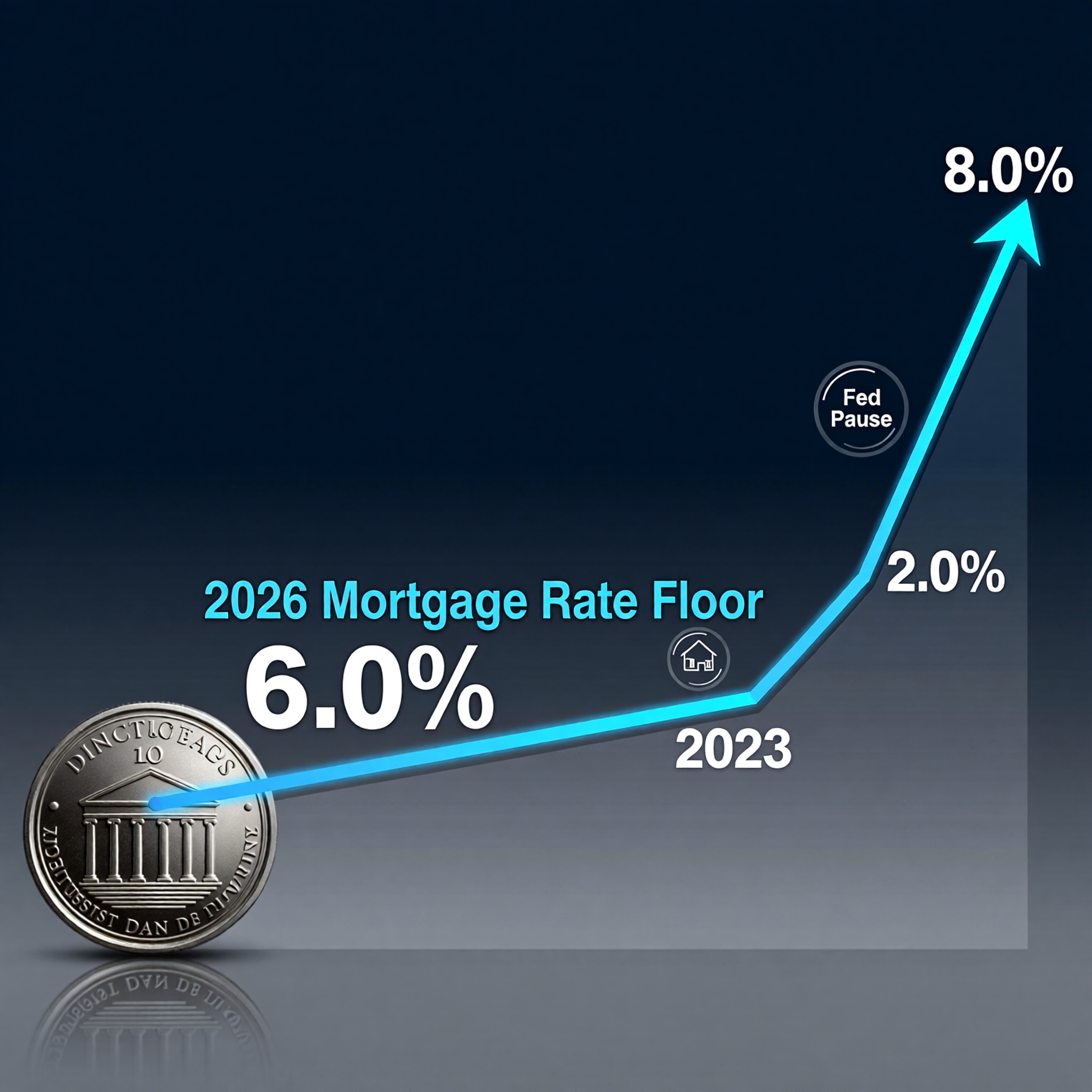

Mortgage Rates 2026 Hit Critical 6.0% “Floor” Following Fed Pause

In the begining of the new year, U.S. mortgage rates 2026 settled into a stubborn range just above 6.0%—not because inflation has vanished, but because the Federal Reserve has signaled a strategic pause in its rate-hiking cycle. This psychological and economic threshold is now being called the “6.0% floor”: a level below which rates are unlikely to drop significantly in the near term, despite hopes for relief.

For homebuyers, refinancers, and real estate investors, this development marks a pivotal shift. The era of sub-3% mortgages is over. But the chaos of 8%+ rates may also be easing. What does a 6.0% “floor” mean for your financial decisions in 2026? And more importantly—how can you navigate this new normal with confidence?

This in-depth analysis explores the forces behind the Fed’s pause, why 6.0% is acting as a structural floor, and what it means for your mortgage strategy in the months ahead.

The Fed’s Pause: A Signal of Stability, Not Surrender

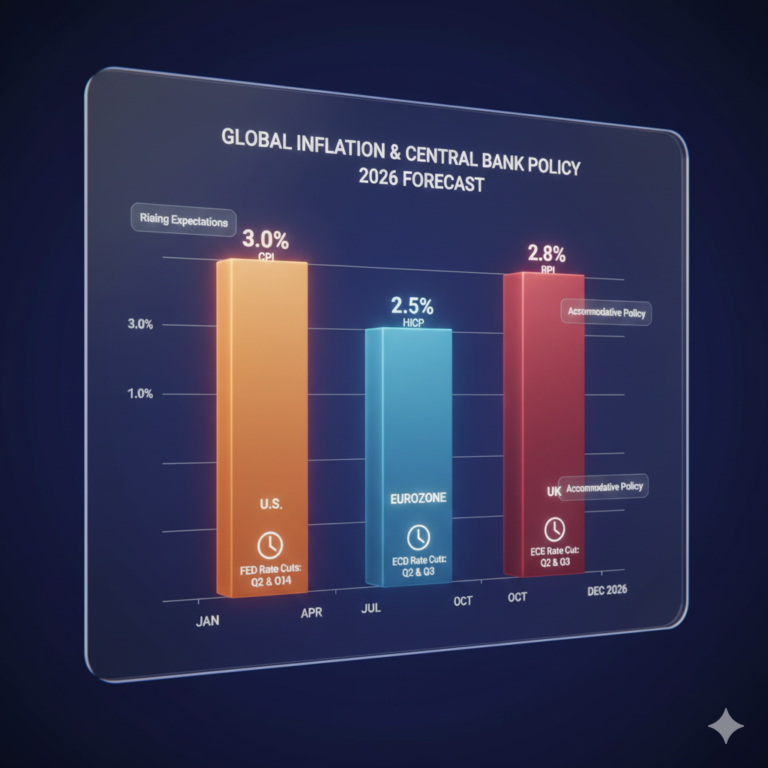

In December 2025, the Federal Open Market Committee (FOMC) held its benchmark federal funds rate steady at 5.25%–5.50%—a level unchanged since July 2023. Chair Jerome Powell emphasized that while inflation has cooled from its 2022 peak (CPI now at ~2.8% YoY), it remains “above our 2% target and persistent in shelter and services.”

Crucially, the Fed signaled no rate cuts before Q3 2026, and even then, only if labor and housing data continue to soften. This patience—some call it caution—has directly influenced long-term Treasury yields, which in turn anchor 30-year fixed mortgage rates.

The 10-year Treasury yield, which typically moves in tandem with mortgage rates, has stabilized between 4.1% and 4.4% in early 2026. Add the standard 1.7–2.0% spread lenders apply for risk and profit, and you land squarely at 5.8%–6.4% for conforming loans. Hence, the 6.0% floor isn’t arbitrary—it’s arithmetic.

Key Insight: Mortgage rates don’t follow the Fed’s current rate—they follow the market’s expectation of future inflation and policy. With the Fed on hold and inflation sticky, 6.0% is the new equilibrium.

Why 6.0% Is a “Floor” (Not a Ceiling)

Many expected rates to plunge after the Fed paused. Instead, they’ve plateaued. Here’s why 6.0% is acting as a durable floor:

- Sticky Core Inflation—Especially in Housing

Even though headline CPI is moderating, “shelter” costs (which include owner’s equivalent rent) remain elevated. This segment makes up nearly one-third of CPI, and it adjusts slowly. Until it cools further, the Fed won’t ease policy aggressively.

- Strong Labor Market = Consumer Spending Power

Unemployment remains below 4.0%, and wage growth hovers near 4%. While good for the economy, this sustains demand—and pricing pressure—keeping inflation from falling rapidly.

- Bank Funding Costs Remain Elevated

After the regional banking stress of 2023–2024, lenders face higher capital requirements and deposit competition. They’re less willing to offer ultra-low rates, even if Treasuries dip slightly.

- Global Capital Flows Are Less Supportive

In past cycles, foreign demand for U.S. Treasuries helped suppress yields. Today, geopolitical fragmentation and stronger yields in Europe/Asia reduce that “flight to safety” effect.

Together, these forces create a structural resistance to mortgage rates falling below 6.0% in the first half of 2026.

What This Means for Homebuyers:

If you’ve been waiting for rates to return to 3% or 4%, it’s time to reset expectations. The 6.0% floor changes the calculus—but doesn’t end homeownership dreams.

Affordability Is Challenging—But Manageable

At 6.0%, a $400,000 loan carries a monthly principal and interest payment of ~$2,398—nearly $900 more per month than at 3.0%. However, compared to 8.0% ($2,958/month), it’s a 19% reduction in payment.

This sweet spot could unleash pent-up demand, especially if home prices stabilize (which they’re beginning to do in many Sun Belt and Midwest markets).

Strategy Shift: Buy Now or Wait?

Buy now if: You have a stable income, a 10–20% down payment, and plan to stay 5+ years. Locking in 6.0% may be wise if rates inch back up later in 2026 due to election volatility or oil shocks.

Wait if: You’re credit-building, saving for a larger down payment, or eyeing markets with high inventory (where price concessions may offset rate costs).

💡 Pro Tip: Consider buy-down points. Paying 1–2% upfront to reduce your rate by 0.25–0.50% can make sense if you’ll stay in the home beyond the break-even point (typically 4–7 years).

Refinancing? Not Yet—But Prepare

With the 6.0% floor in place, cash-out and rate-and-term refinancing remain largely sidelined—unless your existing rate is above 7.0%.

However, two scenarios could revive refi activity in late 2026:

The Fed begins cutting rates in Q4, pushing mortgage rates toward 5.5%.

Home equity builds, enabling access to lower HELOC or lump-sum options.

For now, focus on refi readiness:

Boost your credit score above 740

Reduce debt-to-income (DTI) below 36%

Monitor your home’s appraised value

When the window opens, you’ll be first in line.

Regional Variations: Where 6.0% Feels Different

The national average masks important local dynamics:

| **Region** | Avg. Rate (Jan 2026) | Key Driver |

| Midwest | 5.85% | High inventory, lower home prices |

| South | 5.95% | Strong migration, competitive lenders |

| West | 6.15% | High home values, stricter underwriting |

| Northeast | 6.05% | Older housing stock, slower turnover |

Borrowers in the Midwest and South may find rates below 6.0% with strong credit and local credit unions—another reason to shop around.

The Hidden Opportunity: Adjustable-Rate Mortgages (ARMs) mortgage rates 2026:

While 30-year fixed loans dominate headlines, 5/1 and 7/1 ARMs are gaining traction in 2026.

With initial rates as low as 5.25%–5.50%, ARMs offer meaningful short-term savings. And with the Fed on hold, rate resets in years 6–7 may not spike as feared.

Best for:

Buyers planning to sell or refinance within 7 years

High-income earners with variable bonuses

Investors using mortgages as temporary leverage

Just ensure you model worst-case scenarios (e.g., +2% at reset) to avoid payment shock.

Forecast: Will Rates Break Below 6.0% in 2026?

Most major institutions—Fannie Mae, MBA, Goldman Sachs—project average 30-year fixed rates between 5.8% and 6.3% for all of 2026. A dip below 6.0% is possible in Q2 or Q3, but unlikely to be sustained unless:

CPI falls below 2.0% for two consecutive months

Unemployment jumps above 4.5%

The Fed signals multiple rate cuts

Until then, 6.0% is the new normal—not a temporary dip, but a structural reset.

Action Plan: 5 Steps to Navigate the 6.0% Floor

Get pre-approved now

Lenders are less overwhelmed than in 2023–2024. Locking a pre-approval gives you negotiating power.

Compare lenders aggressively

Rates can vary by 0.25–0.50% between banks, credit unions, and online lenders. Use tools like Yieldoom.com to track real-time offers.

Consider shorter loan terms

A 20-year fixed at 5.625% may offer similar payments to a 30-year at 6.0%, with far less interest paid.

Lock early—but wisely

Rate locks now typically last 30–60 days. If closing takes longer, explore float-down options.

Think total cost, not just rate

A “low rate” with high origination fees or discount points may cost more long-term. Calculate APR, not just the headline number.

The Bigger Picture: Housing Market Stability Returns

Ironically, the 6.0% floor may bring much-needed stability. Wild rate swings from 3% to 8% froze the market—sellers wouldn’t list, buyers couldn’t qualify. Now, with rates in a predictable band, transaction volume is slowly returning.

Existing home sales rose 4.2% MoM in December 2025—the first sustained increase in 18 months. New construction permits are also up, as builders adjust to the new rate reality.

This isn’t a boom. It’s a reset—one that favors informed, prepared buyers over speculators.

Final Thoughts: Embrace the New Equilibrium

The dream of sub-4% mortgages is over. But panic over 8% rates is behind us. In its place: a 6.0% floor that brings clarity, discipline, and opportunity.

Smart borrowers aren’t waiting for the “perfect” rate. They’re optimizing within the new reality—shopping lenders, leveraging credit, and aligning financing with life goals.

In 2026, mortgage success won’t go to the hopeful. It’ll go to the prepared.

The 6.0% mortgage rate floor changes the game—but not your ability to act wisely.

Yieldoom.com cuts through the confusion with real-time, personalized rate comparisons.

Instead of generic averages, you see offers tailored to your credit, location, and loan type.

We track lender-specific trends, historical shifts, and even break-even points for rate buy-downs.

That way, you know—objectively—whether to lock today or wait.

In uncertain markets, clarity is your greatest asset.

Let Yieldoom turn the 6.0% floor into your strategic starting point

One Comment