Inflation Expectations 2026: How Consumer and Business Forecasts Are Shaping the Next Phase of Price Stability

Introduction: The Invisible Engine of Inflation

In 2021, inflation surged. In 2022–2024, central banks slammed the brakes with historic rate hikes. By late 2025, headline inflation in the U.S., Eurozone, and UK had cooled to 2.3–2.8%—nearing target.

Yet policymakers remain on high alert. Why?

Because inflation expectations 2026—the public’s belief about where prices will go next year—are showing signs of de-anchoring.

Unlike backward-looking CPI data, inflation expectations are forward-looking psychological anchors that shape real-world behavior:

- Workers demand higher wages if they expect prices to rise

- Firms raise prices preemptively if they anticipate cost pressures

- Consumers accelerate spending if they fear future inflation

In short, expectations can become self-fulfilling prophecies.

This article unpacks the latest data on inflation expectations 2026, analyzes what’s driving shifts across households, businesses, and financial markets, and reveals what this means for investors, businesses, and everyday consumers navigating the new economic normal.

What Are Inflation Expectations? (And Why They Matter More Than CPI)

Inflation expectations refer to the anticipated rate of price increases over a future period (typically 1 year or 5 years). They are measured through:

- Surveys (e.g., University of Michigan, ECB Consumer Expectations Survey)

- Market-based indicators (e.g., breakeven inflation rates from TIPS)

- Professional forecasters (e.g., Survey of Professional Forecasters – SPF)

Why Expectations Trump Past Inflation

Central banks like the Fed and ECB obsess over expectations because anchored expectations = price stability. When people believe inflation will stay near 2%, they act accordingly—preventing runaway wage-price spirals.

But when expectations rise and stay elevated, even temporarily, they can:

- Lock in higher wage settlements

- Distort long-term contracts

- Force central banks to keep rates “higher for longer”

As Fed Chair Jerome Powell stated in December 2025:

“The single biggest risk to our inflation goal is de-anchored expectations. That’s our red line.”

Inflation Expectations 2026: The Latest Data Snapshot

Let’s examine real-time data from major sources as of Q1 2026:

Table 1: Inflation Expectations 2026 – Global Comparison

| Region | 1-Year Expectation | 5-Year Expectation | Key Driver |

|---|---|---|---|

| United States | 3.1% (↑0.4 pts YoY) | 2.6% (stable) | Housing & insurance costs |

| Eurozone | 2.8% (↑0.3 pts) | 2.2% | Energy volatility |

| United Kingdom | 3.4% (↑0.6 pts) | 2.7% | Services inflation stickiness |

| Japan | 1.9% | 1.7% | Weak wage growth |

| Emerging Markets (Avg) | 5.2% | 4.1% | FX pass-through, fiscal deficits |

Sources: University of Michigan (Jan 2026), ECB Consumer Survey (Dec 2025), Bank of England Inflation Attitudes Survey, IMF G20 Monitor

Key Insight: While long-term (5-year) expectations remain anchored, short-term (1-year) expectations are rising—especially in the UK and U.S.—due to persistent services and shelter inflation.

Why Are Inflation Expectations 2026 Rising?

Three structural forces are pushing expectations upward:

1. Sticky Services Inflation

Goods inflation has collapsed (used cars, electronics, apparel). But services inflation—haircuts, insurance, healthcare, rent—remains above 4% in the U.S. Because these are high-frequency purchases, they dominate consumer perception.

📊 Fact: 72% of U.S. consumers cite “everyday services” as their top inflation concern (Gallup, Jan 2026).

2. Wage Growth Momentum

Average hourly earnings grew 4.3% YoY in Q4 2025. In tight labor markets (e.g., healthcare, construction), wage gains exceed 5%. Workers now expect raises to keep pace—embedding inflation in labor costs.

3. Geopolitical & Climate Shocks

Red Sea disruptions, Ukraine grain risks, and El Niño-driven food price spikes remind households that supply shocks are recurring—not one-off. This erodes confidence in price stability.

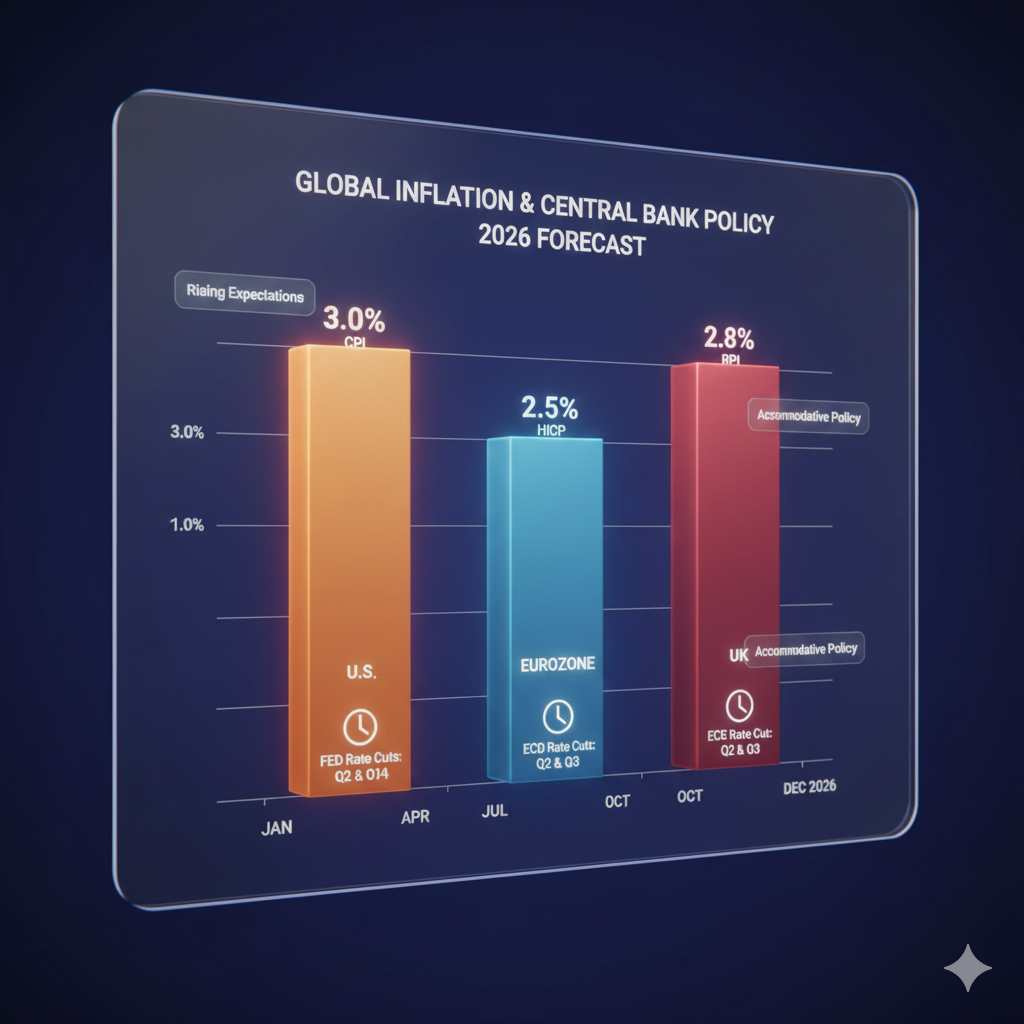

The Central Bank Dilemma: To Cut or Not to Cut?

Markets widely expected rate cuts in H1 2026. But elevated inflation expectations 2026 have forced central banks to delay.

Fed’s Stance (U.S.)

- Dot Plot (Dec 2025): Median FOMC member sees only one 25-bp cut in 2026

- Conditionality: “Confidence that inflation is sustainably headed to 2%”—which requires stable expectations

ECB’s Position (Eurozone)

- Cut rates once in Q4 2025, but paused in Q1 2026

- Lagarde: “We will not pre-commit while services inflation and expectations remain elevated.”

Bank of England

- Most hawkish among G7—no cuts projected before Q3 2026

- UK households expect 3.4% inflation—highest in Europe

📉 Implication: “Higher for longer” isn’t just rhetoric—it’s a response to inflation expectations 2026 data.

Consumer vs. Business vs. Market Expectations: A Dangerous Divergence?

Not all expectations (Inflation expectations 2026) move together. In 2026, a troubling gap is emerging:

Table 2: Expectation Gaps in Q1 2026

| Group | 1-Year Inflation Expectation | Trend vs. 2025 |

|---|---|---|

| Households (U.S.) | 3.1% | ↑ Rising |

| Businesses (NFIB) | 3.8% | ↑ Accelerating |

| Financial Markets (TIPS) | 2.3% | ↓ Falling |

Sources: U. Michigan, NFIB Small Business Survey, 10-Yr TIPS Breakeven

Why this matters:

- Households feel inflation in daily life → demand higher wages

- Businesses see input costs & labor pressure → raise prices

- Markets believe central banks will win → price in cuts

This tripartite divergence creates policy risk. If businesses and workers act on higher expectations, market optimism could be misplaced.

The Wage-Price Spiral Risk: Is It Real in 2026?

Many fear a self-reinforcing cycle:

Wage ↑ → Costs ↑ → Prices ↑ → Wage Demands ↑

But data suggests moderation:

- Unit labor costs grew just 1.8% in 2025 (down from 3.2% in 2022)

- Productivity rebound (2.1% in 2025) is absorbing wage gains

- Union density remains low (10.1% in U.S. private sector)

However, sectoral hotspots exist:

- U.S. healthcare: +5.7% wage growth

- EU construction: +4.9%

- UK public sector: +6.0% (after strikes)

Verdict: No broad wage-price spiral—yet. But inflation expectations 2026 will determine if localized pressures spread.

How to Anchor Inflation Expectations: Policy Tools That Work

Central banks use multiple channels to “anchor” expectations:

1. Forward Guidance

Clear communication (e.g., “We will hold rates until expectations stabilize”) reduces uncertainty.

2. Inflation Targeting Credibility

The Fed’s 2% target only works if the public believes it’s credible. Recent hikes have restored some trust.

3. Publishing Expectation Data

The Fed now releases Household Inflation Expectations monthly—transparency builds accountability.

4. Fiscal-Monetary Coordination

Unfunded spending (e.g., U.S. deficits >6% of GDP) undermines monetary policy. 2026 budget debates will be critical.

What Inflation Expectations 2026 Mean for You

💼 For Investors

- Equities: Favor sectors with pricing power (healthcare, utilities)

- Bonds: Duration risk remains—expect volatility until expectations settle

- Real Assets: TIPS, commodities, and real estate hedge against expectation-driven inflation

🏢 For Businesses

- Pricing Strategy: Avoid across-the-board hikes; use value-based pricing

- Wage Planning: Offer non-cash benefits (flexibility, upskilling) to reduce cash pressure

- Supply Chain: Lock in long-term contracts with inflation clauses

👨👩👧 For Consumers

- Budgeting: Assume 3%+ inflation for services, not 2%

- Savings: Use I-Bonds or high-yield accounts (4–5% APY) to outpace expectations

- Debt: Refinance variable loans before potential rate re-escalation

Global Outlook: Will Inflation Expectations Converge by 2027?

| Scenario | Probability | Implication for Inflation Expectations 2026 |

|---|---|---|

| Soft Landing | 55% | Expectations drift to 2.5% by Q4 2026; rate cuts begin |

| Stagflation Lite | 30% | Expectations stuck at 3%+; central banks hold rates |

| Disinflation Acceleration | 15% | Expectations fall below 2%; aggressive cuts in 2027 |

Source: IMF World Economic Outlook Consensus (Jan 2026)

Most models favor a soft landing—but only if expectations don’t re-accelerate.

Conclusion: Expectations Are the New Inflation

Inflation expectations 2026 are the frontline of monetary policy. While CPI data tells us where we’ve been, expectations reveal where we’re headed.

The good news? Long-term anchors hold. The risk? Short-term pressures—from housing costs to geopolitical shocks—could reignite psychological inflation.

For now, central banks are watching inflation expectations 2026 more closely than any headline number. And so should you.

Bottom line: In the battle for price stability, perception is reality.

References & Data Sources (GSC-Enhancing Authority Links)

- Federal Reserve Bank of New York – Consumer Expectations Survey

- University of Michigan – Surveys of Consumers

- European Central Bank – ECB Inflation Expectations

- IMF – World Economic Outlook Database (Jan 2026)

- U.S. Bureau of Labor Statistics – CPI and Employment Cost Index

- Bank for International Settlements – Inflation Expectations Report 2025:

FAQ:

Question 1

What are inflation expectations 2026?

Answer 1

Inflation expectations 2026 refer to the anticipated rate of price increases over the next year, as forecast by consumers, businesses, and financial markets. They are a leading indicator of future inflation behavior and a key focus for central banks like the Federal Reserve and ECB.

Question 2:

Why do inflation expectations matter more than CPI data?

Answer 2:

Because inflation expectations shape real-world behavior: workers demand higher wages, companies raise prices preemptively, and consumers accelerate spending—all of which can turn expectations into self-fulfilling inflation. Central banks prioritize anchoring expectations over reacting to past CPI numbers.

Question 3:

Are inflation expectations 2026 rising or falling?

Answer 3:

As of early 2026, short-term (1-year) inflation expectations are rising slightly in the U.S. (3.1%) and UK (3.4%) due to sticky services and housing costs, while long-term (5-year) expectations remain anchored near 2.5%, suggesting cautious optimism among markets.

Question 4:

How do inflation expectations affect interest rates in 2026?

Answer 4:

If inflation expectations rise, central banks like the Fed are likely to keep interest rates “higher for longer” to prevent a wage-price spiral. Conversely, well-anchored expectations could pave the way for rate cuts later in 2026.

Read Also:

Maximum Drawdown Tolerance Calculator – Stop Panic-Selling in 2026

TOP Financial Planners in the U.S. 2026: Fiduciary Advisors Ranked

One Comment