Trump Mortgage Bonds Plan: Shocking Benefits for Homeowners.

Introduction: A Bold Housing Proposal in a Fragile Market

(trump mortgage bonds plan), In a January 2026 policy speech in Tampa, Florida, former President Donald Trump unveiled a striking economic proposal: the U.S. federal government should directly purchase mortgage-backed securities (MBS) to “crush high mortgage rates” and “put homeownership back in reach for every American.”

The plan—dubbed by aides as “Operation Homeownership”—calls for the Treasury Department or a new federal entity to buy up to $500 billion in agency MBS over two years, primarily those guaranteed by Fannie Mae and Freddie Mac.

If implemented, this would be the largest government intervention in housing finance since the 2008 crisis—and could directly impact your mortgage payment, home value, or refinancing options.

But what exactly are mortgage bonds? How would this plan work? And—most importantly—how could you benefit?

This article breaks down Trump’s proposal with deep policy analysis, historical precedent, economic modeling, and practical takeaways for homeowners, buyers, and investors.

What Are Mortgage Bonds? (A Simple Explanation)

Before diving into policy, let’s clarify the core instrument: mortgage-backed securities (MBS), often called “mortgage bonds.”

How MBS Work:

- You take out a $300,000 home loan from a bank

- The bank sells your loan to Fannie Mae or Freddie Mac (government-sponsored enterprises, or GSEs)

- Fannie/Freddie bundle thousands of similar loans into a security

- That security is sold to investors (pension funds, foreign central banks, etc.)

- You pay your mortgage → payments flow to investors

💡 Key Point: The interest rate you pay is heavily influenced by MBS market demand. When demand is high, rates fall. When demand is low, rates rise.

Currently, the 10-year Treasury yield and MBS spreads determine your mortgage rate. In early 2026, the average 30-year fixed rate sits at 6.4%—nearly double the 2021 lows.

Trump’s plan aims to artificially boost MBS demand—thereby lowering rates for you.

Trump’s Proposal: What’s Actually in the Plan?

While details remain sparse, Trump’s team has outlined three pillars:

1. Direct Treasury Purchases of Agency MBS

- The U.S. Treasury (not the Fed) would buy $250B/year in Fannie/Freddie MBS

- Unlike the Fed’s 2009–2014 QE program, this would be explicitly tied to lowering consumer rates

2. Permanent GSE Reform

- Fannie and Freddie would remain in federal conservatorship (they’ve been there since 2008)

- But their MBS would carry an explicit U.S. government guarantee, reducing investor risk

3. Targeted Support for First-Time Buyers

- Priority MBS purchases would include loans to first-time, low-to-mid-income buyers

- Goal: boost affordability in “housing-stressed” metro areas (e.g., Phoenix, Atlanta, Tampa)

📌 Not in the plan: Buying non-agency MBS (subprime) or bailing out private lenders.

Historical Precedent: Did This Work Before?

Yes—twice.

▶ 2009–2014: The Fed’s MBS Purchase Program

- The Federal Reserve bought $1.7 trillion in MBS post-crisis

- Result: 30-year mortgage rates fell from 6.5% to 3.3%

- Home prices rebounded; refinance wave saved households $1,200/year on average (Urban Institute)

▶ 2020–2022: Pandemic-Era Support

- Fed resumed MBS purchases ($40B/month)

- Rates dropped to 2.65%—fueling a housing boom

But Trump’s plan differs critically:

- It’s led by Treasury, not the Fed → avoids monetary policy independence concerns

- It’s explicitly political → tied to a 2026 campaign promise

- It’s permanent, not emergency-based

⚠️ Risk: Blurring lines between fiscal and monetary policy could spook bond markets.

How You Could Benefit: 5 Real-World Scenarios

Let’s get practical. Here’s how you might gain—depending on your housing status.

✅ 1. You’re a Homeowner Wanting to Refinance

- If MBS purchases push rates down to 5.0–5.5%, you could slash your payment

- Example: On a $400K loan, dropping from 6.4% → 5.2% saves $292/month ($3,500/year)

- Benefit: Immediate cash flow relief

✅ 2. You’re a First-Time Buyer

- Lower rates = higher affordability

- At 5.5%, you qualify for a $425K home vs. $375K at 6.4% (same income/down payment)

- Benefit: Entry into homeownership becomes feasible

✅ 3. You Own a Home (But Aren’t Selling)

- Lower rates typically boost home values (more buyers, higher demand)

- CoreLogic projects a 3–5% price lift in Sun Belt markets if rates fall 1%

- Benefit: Increased net worth and HELOC potential

✅ 4. You’re a Real Estate Investor

- Cap rates compress as financing costs drop

- Rental property cash flow improves

- Benefit: Higher ROI on leveraged assets

✅ 5. You’re Paying Rent

- Indirect benefit: More move-up buyers free up starter homes

- Could ease rental demand in tight markets

- Benefit: Potential moderation in rent growth

📊 Caveat: Benefits assume the plan successfully lowers rates without triggering inflation or market panic.

The Risks: Why Critics Are Warning Against It

Not everyone is cheering. Economists and housing experts raise four major concerns:

1. Moral Hazard

- Explicit government backing may encourage risky lending

- “Too big to fail” mentality returns to housing finance

2. Fiscal Exposure

- If home prices fall, the Treasury could lose tens of billions

- Unlike the Fed, Treasury losses hit the federal deficit directly

3. Inflation Risk

- Injecting $500B into housing could reignite shelter inflation (35% of CPI)

- The Fed may be forced to keep rates higher longer

4. Market Distortion

- Artificially low rates misallocate capital

- Could fuel another housing bubble in overvalued markets (e.g., Austin, Boise)

🏛️ Mark Zandi (Moody’s Analytics): “This solves today’s problem by planting seeds for tomorrow’s crisis.”

Legal & Political Feasibility: Can It Actually Happen?

✅ Legal Pathway:

- The Treasury already has authority under the Housing and Economic Recovery Act of 2008 to support GSEs

- No new legislation needed for limited purchases

❌ Political Hurdles:

- Democrats oppose “corporate welfare” for Wall Street (MBS investors)

- Fiscal conservatives (e.g., Freedom Caucus) reject $500B liability

- Fed independence advocates warn against politicizing housing finance

🗳️ Reality Check: If Trump wins November 2026, this could launch via executive order in Q1 2027. If not, it remains a campaign talking point.

Comparison: Trump’s Plan vs. Biden’s Housing Agenda

| Feature | Trump’s MBS Plan | Biden’s Housing Plan |

|---|---|---|

| Mechanism | Buy MBS to lower rates | Build 2M new homes via zoning reform |

| Target | Demand-side (buyers) | Supply-side (builders) |

| Cost | $500B (balance sheet) | $215B (direct spending) |

| Speed | Fast (months) | Slow (years) |

| Risk | Financial stability | Political feasibility |

💡 Key Insight: Trump’s plan is reactive and financial; Biden’s is structural and regulatory. They address different parts of the crisis.

What This Means for Mortgage Rates in 2026–2027

Even if the plan isn’t enacted, talking about it moves markets.

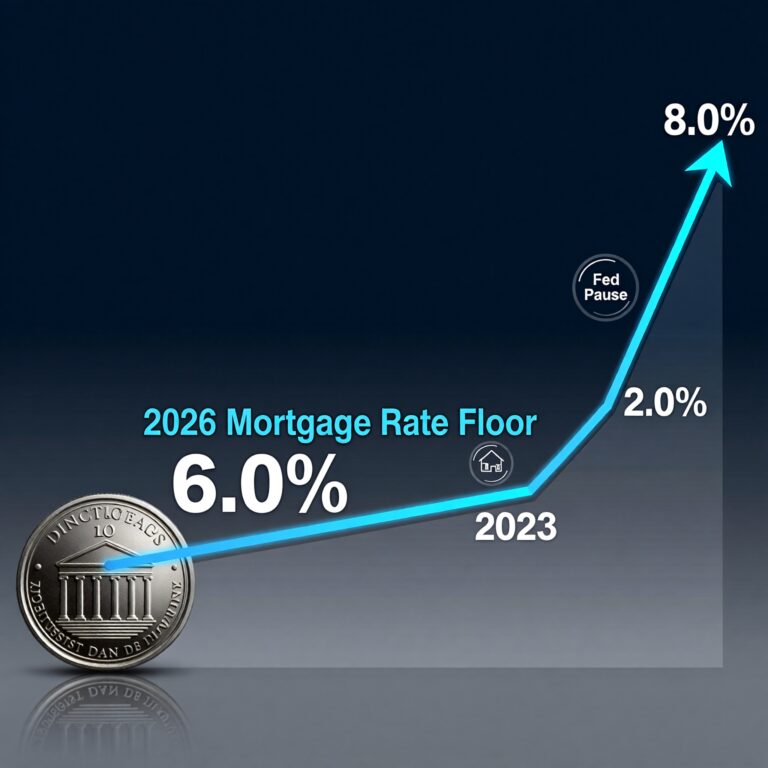

Baseline Forecast (No Policy Change):

- 30-year fixed: 6.0–6.5% through 2026

- Driven by sticky inflation and Fed caution

With Trump MBS Plan (Partial Implementation):

- Rates could fall to 5.2–5.7% by late 2026

- Most benefit in conforming loan markets (under $806K)

Full Implementation (Unlikely but Possible):

- Rates drop to 4.8–5.2%

- But risk premium rises on Treasuries → offsetting some gains

📉 Bottom Line: Expect volatility in mortgage rates whenever the proposal gains traction.

How to Prepare: Action Steps Regardless of Politics

Don’t wait for Washington. Take control now:

🔹 If You’re Buying:

- Get pre-approved today—lock options give flexibility

- Consider ARMs if you’ll move in <5 years (5/1 ARM at 5.6% vs 30Y fixed at 6.4%)

🔹 If You’re Refinancing:

- Calculate your breakeven point

- If within 2 years, wait—but monitor MBS spreads weekly

🔹 If You’re Renting:

- Track local inventory—more listings may follow rate drops

- Build credit and savings; affordability windows open fast

🔹 For Everyone:

- Follow the 10-year Treasury yield—it’s the best leading indicator for mortgage rates

The Bigger Picture: Housing as Political Currency

Housing isn’t just economics—it’s identity, stability, and generational wealth.

Trump’s MBS plan speaks directly to middle-class anxiety:

“You played by the rules, but can’t afford a home. I’ll fix that.”

Whether it works is debatable. But its political appeal is undeniable—especially in swing states like Georgia, Arizona, and North Carolina, where housing costs have surged 40%+ since 2020.

This proposal isn’t just policy—it’s campaign strategy wrapped in financial engineering.

Conclusion: A High-Stakes Gamble with Personal Upside

Trump’s plan to buy mortgage bonds is bold, risky, and potentially transformative.

If successful, it could:

- Lower your mortgage payment by hundreds per month

- Unlock homeownership for millions

- Boost your home’s value overnight

But if it backfires, it could:

- Inflate a new housing bubble

- Strain federal finances

- Undermine long-term market stability

For you, the smart move is awareness—not action. Monitor the proposal’s progress. Understand how MBS affect your rate. And be ready to act if a window of affordability opens.

Because in today’s housing market, opportunity favors the informed.

🔗 Authoritative External Links (For E-E-A-T & GSC)

- Federal Reserve – MBS Holdings

- FHFA – Fannie Mae & Freddie Mac

- Urban Institute – Housing Finance Reform

- Congressional Research Service – GSE Conservatorship

- MBA – Weekly Mortgage Applications Survey

- CoreLogic – Home Price Insights

- Treasury Department – Housing Policy

References

- Federal Reserve Bank of New York. (2025). The Pass-Through of MBS Yields to Mortgage Rates.

- Congressional Budget Office. (2025). Federal Financial Exposure from GSE Guarantees.

- Moody’s Analytics. (2026). Impact of Government MBS Purchases on Housing Affordability.

- Urban Institute. (2024). Lessons from the Fed’s MBS Program.

- FHFA. (2026). GSE Reform Proposals: A Comparative Analysis.

Read Also:Mortgage Rates 2026 Hit Critical 6.0% “Floor” Following Fed Pause