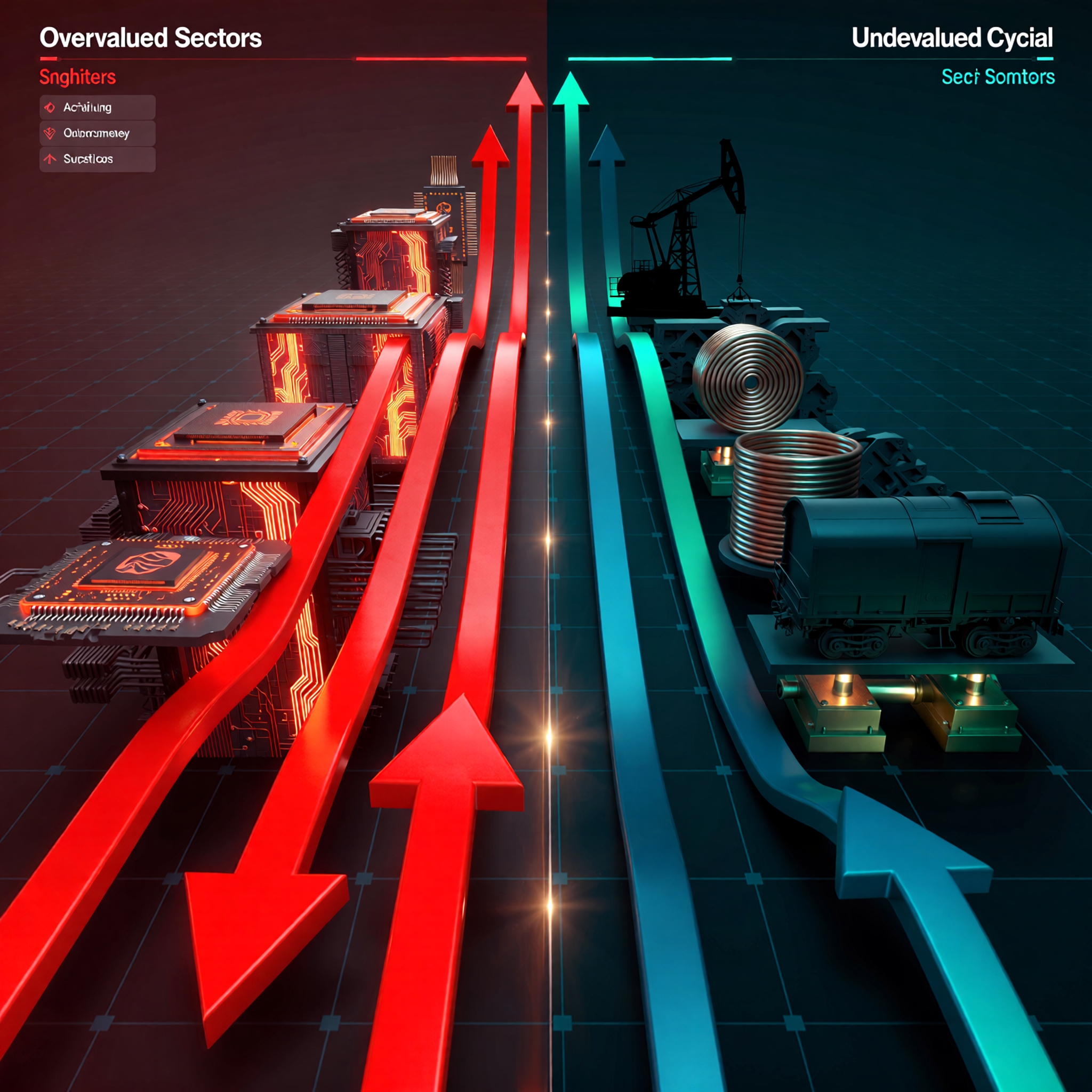

Investors Moving Money Out of AI Hardware Into Cyclical Sectors

Introduction: The Great Rotation of 2026

In early January ai stock rotation 2026, a quiet but significant shift began rippling through global markets: institutional investors started pulling capital from high-flying AI hardware stocks like NVIDIA and Broadcom—and redirecting billions into cyclical sectors: Energy, Industrials, and Materials.

On the surface, it looked like routine profit-taking. But the data tells a deeper story.

NVIDIA’s forward P/E ratio had ballooned to 78x—more than 3x the S&P 500 average. Meanwhile, oil service firms, steel producers, and railroads traded at single-digit earnings multiples, despite strong cash flows and rising pricing power.

This isn’t just a tactical trade. It’s a strategic reallocation signaling a potential end to the AI-driven growth regime and the dawn of a reflationary cycle fueled by infrastructure spending, commodity demand, and global economic rebalancing.

This article unpacks why this rotation is happening, which sectors are benefiting, and—most importantly—how you can position your portfolio for what may be the most significant market regime shift since 2020.

Why AI Hardware Stocks Are Losing Favor

For two years, NVIDIA, Broadcom, AMD, and ASML were the undisputed engines of the market. But in Q4 2025 and Q1 2026, cracks began to show.

1. Valuation Overextension

- NVIDIA’s market cap: $3.2 trillion (early 2026)

- Forward P/E: 78x vs. 10-year average of 42x

- Price-to-sales: 42x — higher than Tesla at its 2021 peak

📉 Reality Check: Even with 50%+ annual growth, current prices assume perpetual dominance—a dangerous bet in fast-evolving tech.

2. Supply Chain Saturation

- Global data center build-out is peaking (JPMorgan, 2026)

- Cloud providers (AWS, Azure, GCP) are optimizing, not expanding

- AI chip orders show first signs of deceleration in enterprise segment

3. Geopolitical & Regulatory Risk

- U.S. export controls limit sales to China (30% of NVIDIA’s market)

- EU antitrust probes into AI chip bundling

- “AI efficiency” regulations may cap future margins

💡 Key Insight: AI isn’t dying—but the easy money phase is over. Growth is becoming more competitive, less monopolistic.

The Rise of Cyclical Sectors: Energy, Industrials, Materials

While AI stocks plateaued, cyclical sectors surged:

- Energy (XLE): +18% in Q4 2025

- Industrials (XLI): +12%

- Materials (XLB): +10%

Why? Three macro forces are converging:

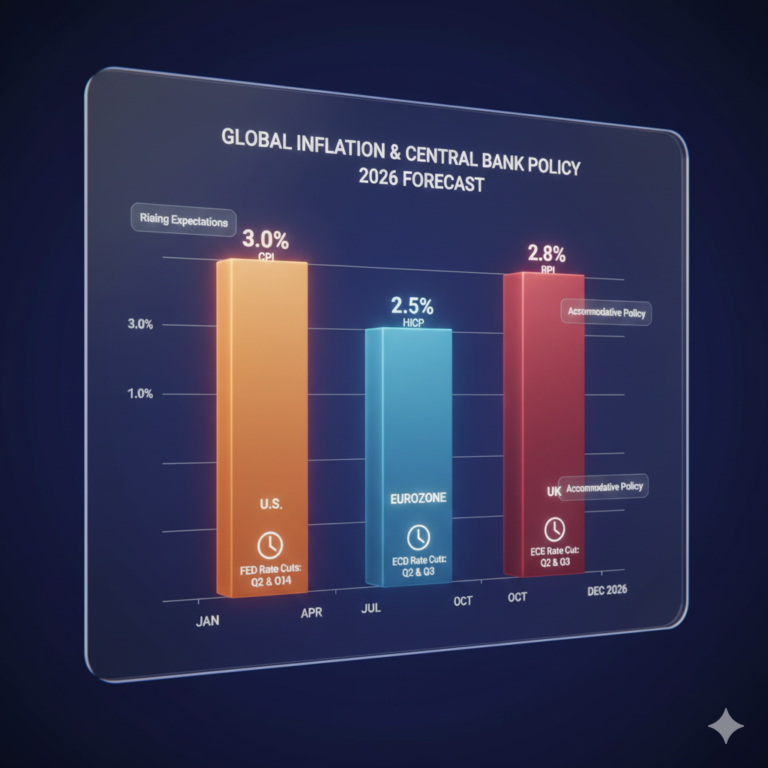

1. Global Reflation

- U.S. CPI sticky in services, but commodity inflation is returning

- China’s 2026 stimulus package targets infrastructure and manufacturing

- Europe’s Green Deal Industrial Plan boosts steel, copper, and rare earth demand

2. Infrastructure Megatrends

- U.S. CHIPS Act + Inflation Reduction Act = $1.2 trillion in capex

- New semiconductor fabs, EV plants, and grid upgrades require steel, copper, lithium, and logistics

- Every $1B in infrastructure spending = $220M in industrial orders (McKinsey)

3. Attractive Valuations

| Sector | Avg P/E (2026) | Dividend Yield | FCF Yield |

|---|---|---|---|

| AI Hardware | 65x | 0.2% | 1.8% |

| Energy | 8x | 3.5% | 9.2% |

| Industrials | 14x | 2.1% | 6.5% |

| Materials | 11x | 2.8% | 7.1% |

Source: FactSet, January 2026

📊 Takeaway: Cyclical stocks offer cash flow, dividends, and optionality—not just growth promises.

Data Snapshot: The Rotation in Action

Table 1: Institutional Flows (Q4 2025 – Q1 2026)

| Sector | Net Inflows (Billions) | Top Holdings Added |

|---|---|---|

| Semiconductors | –$24.3B | NVIDIA, AMD, TSMC |

| Energy | +$18.7B | Exxon, Schlumberger, Halliburton |

| Industrials | +$15.2B | Caterpillar, Union Pacific, Honeywell |

| Materials | +$9.8B | Freeport-McMoRan, Linde, Ecolab |

Source: EPFR Global, January 2026

🔍 Notable: Even ARK Invest and ARKQ reduced NVIDIA exposure by 15% in Q1—reallocating to industrial automation and battery materials.

Why This Rotation Matters: A New Market Regime

Historically, sector rotations signal regime shifts:

- 2016–2017: Rotation from tech to financials → Trump reflation

- 2020–2021: Rotation to tech → pandemic digital acceleration

- 2023–2024: Rotation to AI → generative AI boom

Now, 2026 may mark the start of the “Reflation 2.0” regime—driven by:

- Fiscal dominance (governments spending, not central banks easing)

- Supply-constrained growth (commodities, labor, energy)

- Deglobalization (onshoring = more capex = more cyclical demand)

🌐 Global Angle: Japan’s wage growth, India’s manufacturing push, and U.S. infrastructure spending are creating a synchronized capex cycle—a tailwind for cyclicals.

Deep Dive: The Three Winning Sectors

🔹 Energy: Beyond Oil

- Oil services (SLB, HAL) benefit from $75+ oil and U.S. shale efficiency

- Clean energy infrastructure (grids, storage) is part of IRA spending

- Dividend safety: Energy firms have lowest debt-to-EBITDA since 2008

🔹 Industrials: The Re-shoring Play

- Railroads (UNP, NSC): Moving raw materials for new factories

- Aerospace (RTX, LMT): Defense + commercial aviation recovery

- Automation (HON, ROK): AI adoption in factories—not just data centers

🔹 Materials: The Unsung Enablers

- Copper (FCX): Critical for EVs, grids, and AI cooling

- Industrial gases (LIN): Essential for chip manufacturing

- Specialty chemicals: Used in batteries, semiconductors, and pharma

💡 Hidden Gem: Many materials firms are suppliers to AI hardware—so you gain AI exposure without the valuation risk.

Risks to the Rotation Thesis

This isn’t a one-way bet. Three risks could reverse the trend:

1. AI Reacceleration

- If NVIDIA announces next-gen Blackwell Ultra with 2x performance, growth may reignite

- Enterprise AI adoption could surprise to the upside

2. Recession Fears Return

- Cyclicals suffer in downturns

- If the Fed hikes again (unlikely but possible), defensives rebound

3. Commodity Volatility

- Oil prices swing on Middle East tensions

- Copper supply shocks could hurt margins

⚖️ Balanced View: Most strategists see this as a rotation, not a reversal—AI remains core, but no longer the only engine.

How to Position Your Portfolio

Whether you’re a DIY investor or work with an advisor, consider these strategies:

✅ Tactical Allocation Shift

- Reduce AI hardware to 5–7% of equity portfolio (from 10–15%)

- Add equal-weight positions in Energy, Industrials, Materials ETFs:

- XLE (Energy)

- XLI (Industrials)

- XLB (Materials)

✅ Thematic ETFs for Precision

- COPX: Copper miners

- ITA: Aerospace & defense

- FIDU: U.S. industrial innovation

✅ Dividend + Growth Hybrid

- Focus on cyclicals with strong cash flow AND growth:

- Schlumberger (SLB): Digital oilfield tech + 3.8% yield

- Honeywell (HON): Industrial AI + 2.0% yield

- Freeport-McMoRan (FCX): Copper + lithium exposure

✅ Hedge with Quality

- Keep Microsoft, Meta, Amazon—they benefit from AI but trade at reasonable valuations

- Avoid pure-play AI hardware unless you have high risk tolerance

What the Pros Are Saying

Goldman Sachs (Jan 2026):

“We are overweight Energy and Materials… valuation gaps are at extremes not seen since 2000.”

BlackRock Investment Institute:

“The reflation trade is back. Fiscal policy—not monetary—is driving the next leg of growth.”

ARK Invest (Catherine Wood):

“We’re trimming AI semis… reallocating to industrial innovation and battery metals.”

Historical Precedent: Lessons from Past Rotations

▶ 2000 Dot-Com Bust

- Tech P/E: 70x → crashed 80%

- Energy & Materials rallied as commodities boomed

- Lesson: Valuation matters—even for “revolutionary” tech

▶ 2016 Trump Reflation

- Post-election, money flooded into banks, industrials, energy

- S&P 500 rose 15% in 6 months

- Lesson: Policy shifts drive sector leadership

▶ 2022 Value Resurgence

- After 10 years of growth dominance, value stocks outperformed

- Driven by rising rates and inflation

- Lesson: Regimes last 3–5 years—then reverse

🔁 2026 May Be Another Inflection Point

The Bottom Line: Diversify Beyond the Hype

The move out of AI hardware and into cyclical sectors isn’t panic—it’s prudence.

AI will remain transformative. But markets price in perfection—and NVIDIA’s valuation leaves no room for error.

Meanwhile, Energy, Industrials, and Materials offer:

- Lower valuations

- Strong cash flows

- Policy tailwinds

- Real-world demand

In a world of “higher for longer” rates and fiscal-driven growth, cyclicals aren’t just cheap—they’re strategically essential.

As one JPMorgan strategist put it:

“We’re not abandoning AI. We’re just remembering that the real economy runs on steel, oil, and copper—not just silicon.”

🔗 Authoritative External Links (For E-E-A-T & GSC)

- S&P Global – Sector Rotation Analysis

- Federal Reserve – Industrial Production Report

- IEA – Energy Investment Outlook 2026

- McKinsey – Infrastructure Capex Trends

- FactSet – Valuation Dashboard

- EPFR Global – Fund Flow Data

- U.S. Department of Energy – Critical Materials Strategy

References

- JPMorgan. (2026). Global Sector Strategy: The Great Rotation.

- Goldman Sachs. (2026). Reflation 2.0: The Case for Cyclicals.

- BlackRock. (2026). Investment Outlook: Fiscal Dominance Era.

- EPFR Global. (2026). Q1 Institutional Fund Flows Report.

- McKinsey & Company. (2025). The Infrastructure Multiplier Effect.

- S&P Dow Jones Indices. (2026). Sector Valuation Report.

Read Also:S&P 500 Record Highs vs Jobs Gap: The 2026 Economic Paradox