2026 Savings Strategy Tip: The CD Pivot Explained

Introduction: Why Your Cash Needs a New Strategy in 2026

For the past two years, savers enjoyed a rare gift: high-yield savings accounts paying 4–5% APY, with full liquidity and FDIC insurance. It felt like the best of both worlds—safety, yield, and instant access. (cd pivot 2026).

But 2026 changes everything.

The Federal Reserve has signaled at least two rate cuts this year. While that’s good news for borrowers, it’s a warning bell for savers: the era of easy 5% returns on liquid cash is ending.

Enter “The CD Pivot”—2026’s most strategic savings move.

The CD Pivot isn’t about chasing the highest rate. It’s about locking in today’s elevated yields before they disappear, using a disciplined, low-risk approach that balances return, safety, and flexibility.

This article reveals exactly how to execute The CD Pivot—from choosing terms and building ladders to selecting banks and avoiding hidden pitfalls—so you can preserve purchasing power, outpace inflation, and sleep soundly in a shifting rate environment.

What Is “The CD Pivot”? (And Why It’s Critical in 2026)

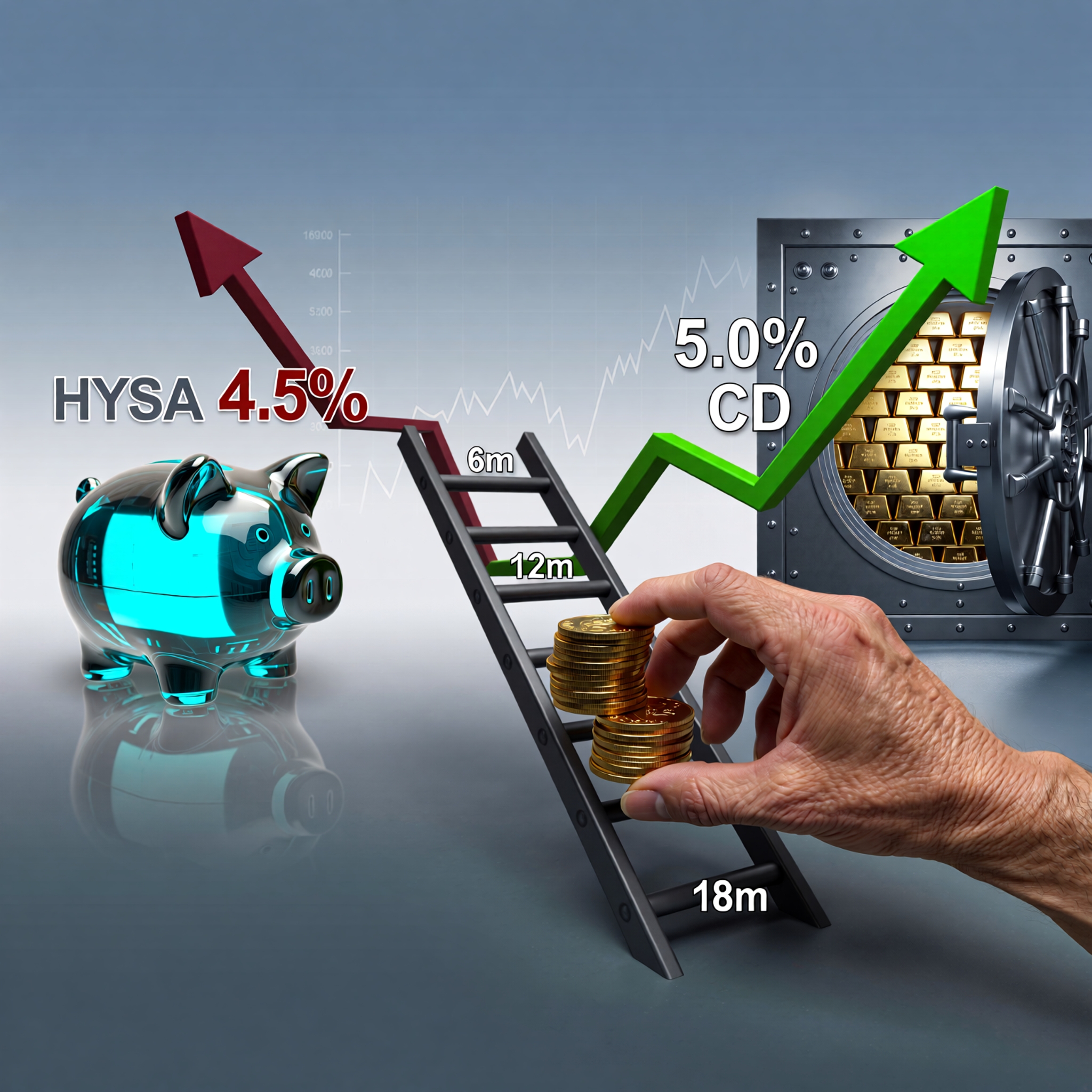

The CD Pivot is a proactive savings strategy where you shift a portion of your emergency fund or short-term savings from liquid accounts (like HYSA) into fixed-term Certificates of Deposit (CDs) to capture today’s high yields before the Fed cuts rates.

Unlike panic-buying long-term CDs, The CD Pivot is structured, flexible, and inflation-aware.

Why Now? The 2026 Rate Outlook

- Current 12-month CD rates: 4.80–5.25% APY

- Fed funds rate: 5.25–5.50% (as of Jan 2026)

- Expected cuts: Two 25-bp cuts by Q4 2026 (per CME FedWatch)

- Projected 12-month CD rate by Dec 2026: 3.25–3.75%

💡 Translation: If you wait, you could lose 150+ basis points in annual yield—permanently, for the life of the CD.

That’s not just “less interest.” It’s $1,500+ in forgone income on a $100,000 savings buffer.

The Problem with “Set-and-Forget” Savings in 2026

Most savers fall into one of two traps:

❌ Trap 1: Staying 100% in High-Yield Savings Accounts (HYSAs)

- Pros: Full liquidity, no penalties

- Cons: Rates drop immediately when the Fed cuts—often within days

- Result: You earn 5% today… but 3.5% by summer, with no protection

❌ Trap 2: Buying One Long-Term CD (e.g., 5-Year at 4.5%)

- Pros: Locked rate

- Cons:

- Lose access to funds (early withdrawal penalties = 6–12 months of interest)

- Miss out if rates rise (unlikely in 2026, but possible)

- Inflation risk: 4.5% may not beat CPI if services inflation rebounds

📉 The Opportunity Cost: Doing nothing = guaranteed yield erosion.

How The CD Pivot Solves This: The Power of Laddering

The CD Pivot’s core tool is the CD ladder—a portfolio of CDs with staggered maturity dates.

Example: A $20,000 CD Ladder (The Classic 5-Rung Model)

| CD Term | Amount | Current APY | Matures |

|---|---|---|---|

| 6-month | $4,000 | 4.60% | July 2026 |

| 12-month | $4,000 | 5.00% | Jan 2027 |

| 18-month | $4,000 | 4.90% | July 2027 |

| 24-month | $4,000 | 4.75% | Jan 2028 |

| 36-month | $4,000 | 4.50% | Jan 2029 |

How it works:

- Every 6 months, a CD matures

- You can reinvest (at new rates), spend, or move to HYSA

- You capture high 2026 rates while retaining liquidity every 6 months

📊 Result: Average yield ≈ 4.75%, with access to 20% of funds every 6 months.

This is The CD Pivot in action: strategic, balanced, and resilient.

Step-by-Step: How to Execute The CD Pivot in 2026

✅ Step 1: Determine Your “Pivot Amount”

Not all savings should go into CDs.

- Keep 3–6 months of expenses in HYSA (true emergency fund)

- Pivot only “stable” savings:

- Down payment fund (6–24 months out)

- Tax payment buffer

- Planned large purchase (car, home renovation)

- “Opportunity fund” (not needed for 6+ months)

💡 Rule of Thumb: Only pivot money you won’t need for at least 6 months.

✅ Step 2: Choose Your Ladder Structure

| Goal | Best Ladder |

|---|---|

| Max yield + moderate liquidity | 5-rung (6/12/18/24/36 mo) |

| Short-term goal (12–18 mo) | 3-rung (6/12/18 mo) |

| Maximum flexibility | Bullet CD + HYSA hybrid |

✅ Step 3: Select the Right Banks

- Online banks (Ally, Marcus, Discover): Highest rates, low fees

- Credit unions (Alliant, Navy FCU): Competitive rates, member benefits

- Avoid: Big bank CDs (Chase, Bank of America)—rates are 1–2% lower

🔍 Pro Tip: Use NerdWallet or Bankrate to compare early withdrawal penalties—some charge 90 days of interest, others 365.

✅ Step 4: Automate & Document

- Set calendar reminders for maturity dates

- Use a simple spreadsheet to track:

- Bank

- Amount

- APY

- Maturity date

- Auto-renewal setting (TURN OFF!)

⚠️ Critical: Most CDs auto-renew at lower rates—you must act at maturity.

CD vs. Alternatives in 2026: Where The Pivot Wins

📊 Table: Savings Options Compared (Jan 2026)

| Account Type | Avg APY | FDIC Insured? | Liquidity | Best For |

|---|---|---|---|---|

| High-Yield Savings | 4.50% | ✅ Yes | Instant | Emergency fund |

| Money Market Account | 4.60% | ✅ Yes | Checks/debit | Spending buffer |

| 6-Month CD | 4.60% | ✅ Yes | Low (penalty) | Short-term goals |

| 12-Month CD | 5.00% | ✅ Yes | Low | The CD Pivot core |

| 2-Year CD | 4.75% | ✅ Yes | Very Low | Yield maximization |

| TIPS (5-Year) | ~3.8%* | ✅ (U.S. Gov) | Medium | Inflation hedge |

| I-Bonds | 4.28%* | ✅ (U.S. Gov) | Low (1-yr hold) | Long-term safety |

*Real yield after inflation; subject to purchase limits

✅ Verdict: For <3-year horizons, CDs offer the best risk-adjusted yield in 2026.

Advanced Tactics: Supercharging Your CD Pivot

🔹 1. Bump-Up CDs

- Pay slightly lower initial rate (e.g., 4.6% vs 5.0%)

- One-time option to “bump up” if rates rise

- Ideal if you fear missing a rate hike (low probability in 2026, but possible)

🔹 2. No-Penalty CDs

- Rates ~0.5–1.0% lower than standard CDs

- Withdraw anytime after 7 days

- Perfect for “just in case” liquidity (e.g., Ally’s 11-month no-penalty CD at 4.25%)

🔹 3. Jumbo CDs ($100K+)

- Often pay 0.10–0.25% more

- Only use if you have excess savings beyond $250K FDIC limit

🔹 4. IRA CDs

- Lock in high rates tax-deferred

- Ideal for retirees or conservative IRA holders

Behavioral Pitfalls to Avoid

❌ 1. Chasing the Absolute Highest Rate

- Saving 0.10% more isn’t worth banking with an unknown institution

- Stick to FDIC-insured, reputable banks

❌ 2. Ignoring Inflation

- A 5% CD sounds great—but if CPI is 3%, your real return is just 2%

- Don’t expect CDs to “beat inflation”—they’re for capital preservation, not growth

❌ 3. Over-Laddering

- 10-rung ladders are overkill for most people

- 3–5 rungs offer the best balance of yield and simplicity

❌ 4. Forgetting Taxes

- CD interest is ordinary income—taxable yearly, even if not withdrawn

- Consider holding CDs in tax-advantaged accounts if in a high bracket

Real-Life Example: How Sarah Used The CD Pivot

Situation:

- Sarah, 38, has $30,000 saved for a home down payment in 18 months

- Currently in HYSA at 4.5%

- Worried rates will fall before she buys

Her CD Pivot:

- Kept $10,000 in HYSA (emergency buffer)

- Built a 3-rung ladder with $20,000:

- $7,000 in 6-month CD @ 4.60%

- $7,000 in 12-month CD @ 5.00%

- $6,000 in 18-month CD @ 4.90%

Result:

- Average yield: 4.83% (vs 4.5% in HYSA)

- First CD matures in July 2026—she can reassess

- If home purchase delays, she reinvests at then-current rates

- Peace of mind: locked in 2026 yields, with staged access

💬 “I’m not gambling on rates. I’m just not leaving money on the table.”

What If Rates Don’t Fall? (The “What-If” Test)

Critics say: “What if inflation rebounds and the Fed hikes again?”

While unlikely in 2026 (consensus forecast: cuts), The CD Pivot still wins:

- Short-term CDs (6–12 mo) mature quickly—you can reinvest at higher rates

- No-penalty CDs offer escape hatches

- Laddering ensures you’re never fully locked in

🛡️ The Pivot is anti-fragile: it works in falling, flat, or rising rate environments.

The Bigger Picture: Why This Matters Beyond Yield

The CD Pivot isn’t just about earning an extra 0.5%. It’s about:

- Taking control in an uncertain world

- Resisting inertia (“I’ll just leave it in savings”)

- Practicing intentional money management

- Building financial resilience one decision at a time

In a world of market volatility and economic noise, mastering your cash is the ultimate act of stability.

Frequently Asked Questions

Q: How much should I put into CDs vs. HYSA?

A: Keep 3–6 months of expenses in HYSA. Pivot only money you won’t need for 6+ months.

Q: Are CD rates expected to fall in 2026?

A: Yes—consensus expects two Fed cuts, pushing 12-month CD rates from ~5% to ~3.5% by year-end.

Q: What’s the best CD term for 2026?

A: 12-month CDs offer the best balance of yield and flexibility right now.

Q: Are CDs safe?

A: Yes—if FDIC-insured (up to $250,000 per bank, per ownership category).

Q: Can I lose money in a CD?

A: Only if you withdraw early and pay a penalty that exceeds earned interest. Otherwise, principal is guaranteed.

Conclusion: Don’t Wait—Pivot Now

The window for The CD Pivot is open but narrowing. Every month you wait, you risk locking in lower yields—or worse, earning nothing as rates drop in your HYSA.

You don’t need to move all your money. You don’t need to predict the future. You just need to act with intention.

Open a CD today. Build a small ladder. Capture 2026’s rare high yields.

Because in the world of savings, the best time to pivot was yesterday. The second-best time is now.

🔗 Authoritative External Links (For E-E-A-T & GSC)

- FDIC – Insured or Not?

- Federal Reserve – Monetary Policy

- U.S. Treasury – I Bonds & TIPS

- Bankrate – Best CD Rates

- NerdWallet – CD Ladder Calculator

- CME FedWatch Tool

- BLS – Consumer Price Index

References

- Federal Reserve. (2026). FOMC Projections, January.

- FDIC. (2026). National Rates and Rate Caps.

- Bankrate. (2026). Weekly CD Rate Report.

- Vanguard. (2025). The Role of Cash in a Rising Rate Environment.

- NerdWallet. (2026). CD Laddering Strategies for 2026.