Mortgage Calculator 2026: Your Clarity in a Confusing Market

If you’re looking at homes in 2026, you’re not just house-hunting—you’re navigating higher rates, elevated prices, and economic uncertainty.(mortgage calculator 2026)

It’s enough to make anyone pause.

“Can I really afford this payment?”

“What if rates drop next year?”

“Should I rent instead?”

These aren’t signs of doubt—they’re signs of wisdom. And you don’t need more noise. You need clarity.

That’s why we built the Yieldoom Mortgage Calculator 2026: a free, no-email tool that answers your biggest mortgage questions in seconds—so you can move forward with confidence, not fea

Mortgage calculator 2026

2026 Mortgage Calculator

Estimate payments, affordability, refinance breakeven, and rent vs. buy—all in one tool.

Monthly Payment Estimate

How Much Can You Afford?

Refinance Breakeven

Rent vs. Buy Analysis

Your Mortgage Snapshot

💡 Why a Mortgage Calculator Matters More Than Ever in 2026

In past decades, mortgage math was simple:

- Rates were low

- Prices rose slowly

- “28/36 rule” was enough

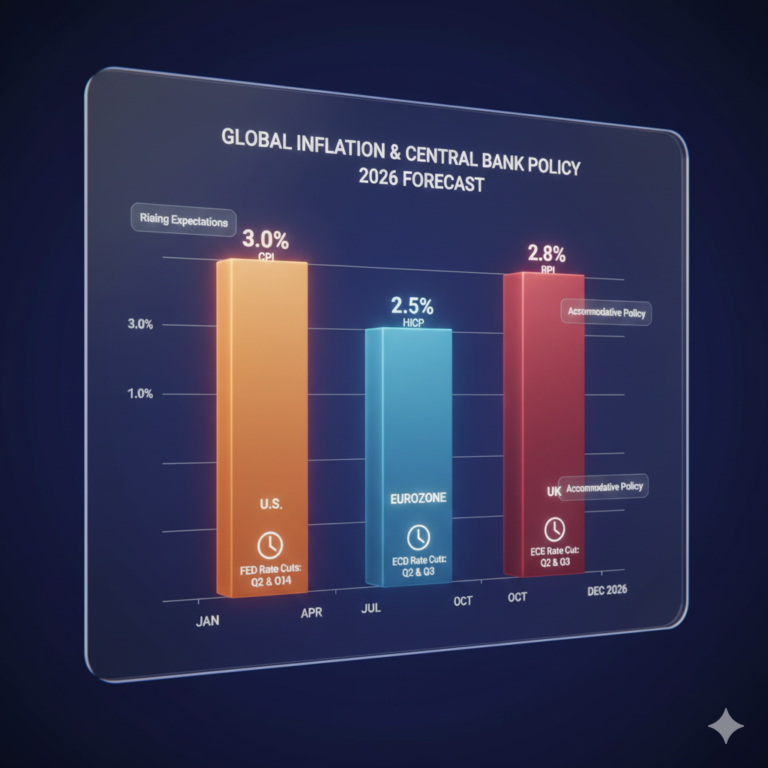

But 2026 is different:

- Rates hover near 6–7% (vs. 3% in 2021)

- Home prices remain high despite rate spikes

- Job markets are AI-disrupted, making income less predictable

In this environment, guessing your payment is risky. You need precision—not just for your budget, but for your peace of mind.

🛠️ What Our Calculator Does For You

Unlike basic online tools, ours is built for real 2026 buyers:

✅ See Your True Monthly Cost

We include principal, interest, taxes, insurance, and PMI—so there are no surprises at closing.

✅ Test “What-If” Scenarios

- What if I put 10% down instead of 20%?

- How much do I save with a 15-year loan?

- What payment can I afford on my income?

✅ Compare Renting vs. Buying

Factor in rent increases, home appreciation, and tax benefits to see which truly wins over time.

✅ Plan a Refinance

Calculate your breakeven point—so you know exactly when refinancing pays off.

📊 Real example:

On a $500K home at 6.5%, your payment is $2,800/month.

But with 10% down, PMI adds $300+/month—a detail many calculators miss.

🤝 You’re Not Just a Borrower—You’re a Planner

Using a mortgage calculator isn’t about getting a number.

It’s about taking control in a market that feels out of control.

It’s about walking into a lender meeting prepared, not pressured.

It’s about knowing your limits before you fall in love with a house.

And most of all—it’s about sleeping well at night, because you’ve done the math.

✅ Get Started in 60 Seconds

- Enter your home price

- Add your down payment and rate

- See your full payment breakdown

- Explore tabs for affordability, refinance, or rent vs. buy

No signup. No spam. Just clarity.

🔚 Final Thought

Homeownership is still the American dream—but in 2026, it demands smarter planning.

Let our calculator be your first step toward a decision you’ll feel good about for years to come.

Because the best mortgage isn’t the biggest one you can get—it’s the one you can live with.

💡 Disclaimer

This tool provides estimates only. Actual terms depend on credit, income, and lender policies. Not a loan offer. Consult a qualified mortgage advisor before applying.