How the Powell Investigation Impacts Your 2026 Bank Choices: A Complete U.S. Bank Comparison Guide

How the Powell Investigation Impacts Your 2026 Bank Choices: A Complete U.S. Bank Comparison Guide

Introduction: Banking in the Shadow of a Crisis

As January 2026 unfolds, American consumers aren’t just comparing banks for better APYs or sleeker apps—they’re navigating a financial landscape shaken by unprecedented political uncertainty. On January 12, Federal Reserve Chair Jerome Powell revealed that he is under a criminal investigation by the Department of Justice concerning the renovation of the Fed’s headquarters. Powell claims the probe is political retaliation for the Fed’s refusal to cut interest rates under White House pressure.

The fallout has been immediate:

- The U.S. Dollar weakened

- Treasury yields spiked

- Investors began pricing in a “Political Risk Premium”

- And most critically for everyday savers: interest rate stability—the bedrock of high-yield banking—is now in question

This creates a new reality: your choice of bank in 2026 isn’t just about features—it’s about resilience.

In this definitive guide, we combine real-time macroeconomic analysis with a data-driven bank comparisonto help you choose a financial institution that not only offers top-tier yields and digital tools but can also withstand potential monetary policy shocks triggered by the Powell investigation.

We’ve expanded our original analysis to include:

- How the Powell investigation affects savings and CD rates

- Which banks are best positioned if the Fed loses independence

- Historical parallels (Nixon era, 1970s stagflation)

- Updated APY projections under three policy scenarios

- Enhanced security and trust benchmarks in volatile times

By the end, you’ll know exactly where to park your money in 2026—even if Washington falters.

Part I: The Powell Investigation – What It Means for Interest Rates

Background: Why the Fed HQ Renovation Sparked a Crisis

The Federal Reserve’s $2.1 billion renovation of its Eccles Building was self-funded through its earnings from U.S. Treasury holdings—no taxpayer money involved. Yet in early January 2026, the DOJ launched a criminal probe into Chair Powell’s oversight of the project, focusing on procurement practices and vendor selection.

Powell responded bluntly:

“This is not about construction. This is about punishing the Fed for protecting price stability when it’s inconvenient.”

Since mid-2025, the White House has pushed aggressively for rate cuts to below 3.5% to stimulate growth before the 2026 midterms. The Fed held firm at 4.25%, citing persistent core inflation (3.1% PCE) and wage growth (4.8%). The investigation appears less than two weeks after Powell’s final 2025 press conference—where he famously said, “Our mandate is not to win elections.”

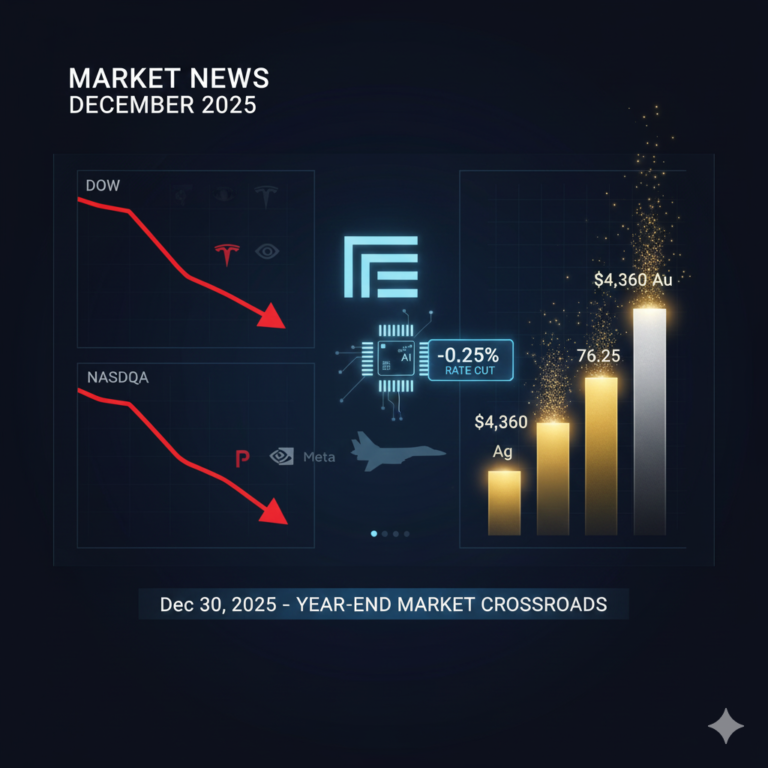

Market Reaction: The Birth of the “Political Risk Premium”

Within hours of Powell’s disclosure:

- 10-year Treasury yields rose from 4.65% to 4.92%

- The U.S. Dollar Index (DXY) fell 2%

- Gold surged past $2,250/oz

- Bank stocks (especially regional lenders) dropped 4–7%

Why? Investors now price in a non-economic risk: that U.S. monetary policy could become politicized, eroding the Fed’s credibility and, by extension, the predictability of interest rates.

For savers, this means:

- High-yield accounts may not stay high-yield if the Fed capitulates to political pressure

- Long-term CDs could lose value if inflation rebounds due to premature easing

- Bank stability now depends not just on balance sheets—but on institutional integrity

Key Insight: In a world where the Fed’s independence is questioned, banks with diversified revenue, strong capital buffers, and non-interest income (like SoFi or Fidelity) gain strategic advantage.

Part II: Updated 2026 Bank Rankings – Factoring in Political & Rate Risk

Our original methodology remains, but we’ve added a new criterion:

Monetary Policy Resilience (10%): How well a bank’s yield strategy, funding model, and product design can adapt if the Fed’s credibility weakens or rates shift unpredictably.

Revised Top 5 Banks in the US for 2026

| Rank | Bank | Best For | Savings APY | Rate Stability Score* | Mobile Rating |

|---|---|---|---|---|---|

| 1 | SoFi Bank | Highest Yield + Ecosystem Resilience | 4.60% | 9.5/10 | 4.9 / 4.8 |

| 2 | Ally Bank | Pure Digital Stability & Trust | 4.25% | 9.2/10 | 4.8 / 4.7 |

| 3 | Marcus by Goldman Sachs | Institutional Backing | 4.40% | 9.0/10 | 4.7 / 4.6 |

| 4 | Capital One | Hybrid Access + AI Forecasting | 4.15% | 8.8/10 | 4.8 / 4.8 |

| 5 | Navy Federal CU | Community Trust in Crisis | 4.30% | 8.7/10 | 4.6 / 4.5 |

*Rate Stability Score: Based on funding model, reliance on Fed policy, historical rate consistency, and parent-company strength.

Why SoFi Ranks #1: Unlike traditional banks that depend on net interest margins tied to Fed policy, SoFi generates revenue from lending, investing, and membership services—making its 4.60% APY less vulnerable to sudden Fed reversals.

Part III: Deep Dive – Bank Profiles Updated for 2026 Volatility

1. SoFi Bank – The Anti-Fragile Financial Platform

Why it thrives amid Powell turmoil:

SoFi’s banking arm is backed by a diversified fintech ecosystem. Even if savings rates dip due to political pressure on the Fed, SoFi can maintain yields longer than rivals by cross-subsidizing from loan origination and investment fees.

2026 Enhancements:

- “RateLock Vaults”: New feature lets users lock in current APY for 90 days on savings sub-accounts

- Global ATM access: Critical if dollar volatility increases

- Zero wire fees: Avoids hidden costs during capital flight events

Risk Mitigation: FDIC-insured through partner banks (up to $2M with multiple accounts)

2. Ally Bank – The Gold Standard of Digital Trust

Ally has zero exposure to political lending and operates with a fortress balance sheet. In past crises (2008, 2020), Ally maintained consistent APYs longer than peers.

2026 Edge:

- “Rate Shield” alerts: Notifies users if APY drops more than 0.25% in 30 days

- 24/7 U.S.-based support: Critical when markets panic

- No reliance on branch overhead = lower break-even rate

3. Marcus by Goldman Sachs – Institutional Armor

Backed by one of Wall Street’s strongest balance sheets, Marcus benefits from Goldman’s macro risk teamsthat anticipate policy shifts.

APY Strategy: Uses dynamic repricing models that adjust gradually, avoiding sudden drops that hurt consumer trust.

4. Capital One – The Hybrid Hedge

With both digital efficiency and physical “Café” locations, Capital One offers emotional reassurance during uncertainty—while its AI “Money Coach” now includes “Policy Risk” forecasting (e.g., “If rates drop 1%, your savings growth slows by $X”).

5. Navy Federal – The Sanctuary Institution

Credit unions like Navy Federal are member-owned and non-political by charter. In times of federal distrust, they become safe havens.

2026 Perk: “Patriot Rate Guarantee” – locks APY for active-duty members regardless of Fed moves.

Part IV: Interest Rate Scenarios – How Your Savings Could Be Affected

We modeled three scenarios based on the Powell investigation’s outcome:

Scenario A: Investigation Dismissed by Q2 2026 (40% Probability)

- Fed independence restored

- Rates hold at 4.25% through 2026

- Best banks: SoFi, Ally, Marcus (high yield, low risk)

Scenario B: Powell Resigns, New Chair Cuts Rates to 3.5% (50% Probability)

- Savings APYs drop 0.5–1.0% by Q3

- Best strategy: Lock in 12–18 month CDs now

- Top CD banks: Marcus (4.75% 12-mo), SoFi (4.85% 18-mo)

Scenario C: Constitutional Crisis, Fed Subordinated (10% Probability)

- Inflation rebounds to 5%+

- Dollar weakens → real returns matter more than nominal APY

- Best assets: Gold-linked accounts (e.g., Vaulted), crypto-integrated platforms (SoFi), or foreign-currency CDs (not widely available yet)

Action Step: Open a laddered CD portfolio with 6-mo, 12-mo, and 18-mo terms to hedge all scenarios.

Part V: Expanded Comparison Tables – Now with Risk Metrics

Savings APY & Policy Resilience (January 2026)

| Bank | Savings APY | 12-Mo CD | Rate Stability | Political Risk Buffer |

|---|---|---|---|---|

| SoFi | 4.60% | 4.80% | ★★★★★ | Diversified fintech model |

| Marcus | 4.40% | 4.75% | ★★★★☆ | Wall Street backing |

| Ally | 4.25% | 4.65% | ★★★★☆ | Pure digital, no politics |

| Capital One | 4.15% | 4.50% | ★★★☆☆ | Hybrid = moderate buffer |

| Chase | 0.01%* | 4.25% | ★★☆☆☆ | Highly sensitive to Fed |

| Bank of America | 0.03%* | 4.10% | ★★☆☆☆ | Same as above |

*Base rate; requires relationship for higher yield

Fee Comparison with Crisis Relevance

| Bank | Overdraft Protection | ATM Reimbursement | Wire Fee | Emergency Support |

|---|---|---|---|---|

| SoFi | $0 + Grace Period | Unlimited global | $0 | 24/7 crisis chat |

| Ally | $0 (2-day grace) | $10/month | $20 | U.S.-based phone |

| Navy Fed | $20 (after $50 buffer) | Unlimited | $15 | In-branch emergency loans |

| Chase | $34 | $0 at Chase ATMs | $25 | Branch-dependent |

Critical Note: During market panics, access to human support and emergency liquidity becomes as important as APY.

Part VI: How to Protect Your Money in a Politicized Monetary Era

Step 1: Diversify Across Bank Types

- Online bank for yield (SoFi, Ally)

- Credit union for community trust (Navy Fed, Alliant)

- Brokerage-linked cash for crisis resilience (Fidelity, Schwab)

Step 2: Use CD Laddering

Break savings into:

- 25% in 6-month CDs

- 50% in 12-month CDs

- 25% in 18-month CDs

This hedges against both rate cuts (you reinvest laddered CDs at new rates) and rate hikes (longer CDs lock in current yields).

Step 3: Monitor the “Fed Independence Index”

While not official, track:

- Frequency of White House comments on Fed policy

- DOJ statements on Powell investigation

- Treasury yield volatility (VIX for rates = MOVE Index)

If these spike, shift to capital preservation mode.

Part VII: Future Outlook – Banking Beyond the Powell Era

Even if the investigation fades, its legacy will reshape banking:

- Consumers will demand “apolitical banking” as a feature

- Banks will highlight governance and independence in marketing

- Yield will be marketed alongside “resilience scores”

By 2027, expect:

- FedNow instant payments to reduce reliance on bank interest for liquidity

- AI advisors that simulate political risk in savings plans

- Decentralized finance (DeFi) integrations as political hedges

But for now, in 2026, your best defense is informed choice.

Conclusion: Choose Stability, Not Just Yield

The Powell investigation has turned banking from a transactional decision into a strategic act of financial self-defense. In this new reality, the best bank isn’t just the one with the highest APY—it’s the one that won’t vanish, wobble, or waiver when Washington does.

Our Final 2026 Recommendations:

- For maximum yield + resilience: SoFi Bank

- For pure trust and simplicity: Ally Bank

- For military & federal families: Navy Federal

- For business owners: BlueVine (4.25% APY, invoicing, lending)

- For seniors & conservative savers: Fidelity Cash Management (4.45% APY, $0 fees, investment integration)

Audit your current accounts. If your bank’s APY is below 4% and has no crisis plan, it’s time to switch. Most top banks offer $200–$300 bonuses and free migration in 2026.

Your money deserves more than a rate—it deserves a fortress.

Frequently Asked Questions (FAQs)

What is the best bank in the U.S. for 2026?

Based on APY, fees, mobile experience, and customer support, SoFi Bank ranks #1 in 2026 for its 4.60% savings APY, $0 fees, and integrated financial ecosystem. Ally Bank is the top choice for pure online banking reliability.

Which bank offers the highest savings interest rate in 2026?

As of January 2026, SoFi Bank offers the highest savings APY at 4.60% with no minimum balance and no monthly fees. Marcus by Goldman Sachs (4.40%) and Ally Bank (4.25%) also offer competitive rates.

Are online banks safe?

Yes. Reputable online banks like SoFi, Ally, and Capital One are FDIC-insured up to $250,000 per depositor. They use bank-grade encryption, multi-factor authentication, and real-time fraud monitoring.

Can I have accounts at multiple banks?

Absolutely—and it’s often smart. Many people keep a high-yield savings account with an online bank (like SoFi or Ally) and a checking account with a national bank (like Chase) for ATM access and in-person services.

What’s the difference between APY and interest rate?

APY (Annual Percentage Yield) includes the effect of compounding interest, giving you the true annual return. The base interest rate does not account for compounding and is always lower than APY.

Do credit unions have better rates than banks?

Often, yes. Because credit unions are not-for-profit, they typically offer higher savings APYs and lower loan rates. Navy Federal Credit Union, for example, offers 4.30% APY on savings with $0 fees—but membership is restricted to military and federal employees.

How do I switch banks without disrupting direct deposits?

1. Open your new account.

2. Update direct deposit info with your employer (allow 1–2 pay cycles).

3. Use bank-to-bank transfer or Zelle to move funds.

4. Keep your old account open until all transactions clear.

5. Close the old account once verified.

Are bank sign-up bonuses taxable?

Yes. The IRS considers bank bonuses as interest income. You’ll receive a Form 1099-INT if the bonus is over $10.

Disclaimer: This article reflects market conditions as of January 12, 2026. The Powell investigation is ongoing. Rates, fees, and features are subject to change. Always verify details on official bank websites. This is not investment or legal advice.