Central Banks Buying Gold at Record Pace as Dollar Credibility Erodes

Central Banks Buying Gold at Record Pace as Dollar Credibility Fades — What It Means for You

“When central banks start buying gold like it’s going out of style, you know something fundamental is shifting.”

— Anonymous G7 Treasury Official, 2025

In a quiet but seismic transformation unfolding across the world’s financial corridors, central banks are no longer just managing inflation or interest rates—they’re actively de-risking their reserve portfolios by dumping dollars and loading up on physical gold.

The catalyst? A growing consensus among policymakers that the U.S. dollar is losing credibility—not because it’s collapsing tomorrow, but because its long-term dominance is being challenged by geopolitical fragmentation, unsustainable debt, and the weaponization of finance.

And the asset they’re turning to? Gold—the one asset with zero counterparty risk, no issuer, and 5,000 years of proven value.

This isn’t speculation. It’s data-driven reality. In 2023 alone, central banks purchased 1,037 tonnes of gold—second only to the record 1,136 tonnes bought in 2022. And early 2026 figures suggest we’re on track for yet another record year.

This article dives deep into:

- Why central banks are scrambling to buy gold

- The geopolitical, economic, and strategic forces behind the trend

- Which countries are leading the charge

- How this impacts gold prices, the dollar, and your portfolio

- What comes next in the global monetary order

Let’s begin.

🌍 Part 1: The Quiet Revolution — Why Central Banks Are Buying Gold Like Never Before

1.1 The Weaponization of Finance Has Changed Everything

The most profound trigger for today’s gold rush came not from markets—but from geopolitics.

In February 2022, following Russia’s invasion of Ukraine, Western governments froze over $300 billion in Russian central bank reserves held in U.S. dollars, euros, and other Western currencies. This wasn’t just a sanction—it was a declaration: Your dollar assets are not safe.

The message was heard loud and clear in Beijing, New Delhi, Brasília, and Ankara.

“If your largest creditor can freeze your reserves overnight, you need an asset that cannot be confiscated, sanctioned, or devalued by decree.”

— Senior IMF economist, speaking anonymously, 2024

For decades, central banks assumed that holding U.S. Treasuries and dollar-denominated assets was “safe.” Now, they realize safety has a new definition: sovereign control + non-sanctionable value.

Enter gold.

Unlike bonds, stocks, or even digital currencies, physical gold cannot be hacked, frozen, or canceled. It’s neutral, universal, and timeless.

1.2 The U.S. Dollar’s Mounting Structural Weaknesses

While the dollar remains the world’s top reserve currency (still ~58% of global reserves), cracks are widening:

➤ Skyrocketing National Debt

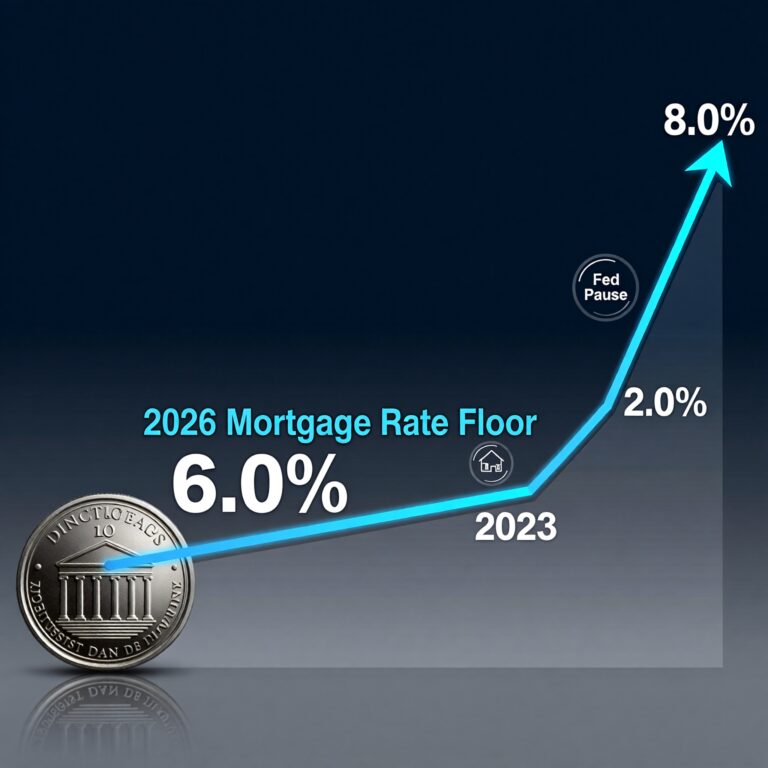

The U.S. national debt has ballooned past $35 trillion—more than 120% of GDP. Annual deficits hover around $2 trillion. At current rates, interest payments alone will consume over 20% of federal revenue by 2030.

➤ Loss of Trust in Fiscal Discipline

Global investors are increasingly questioning whether Washington can manage its finances responsibly. The Federal Reserve’s repeated bailouts—from 2008 to 2020 to 2023—have eroded confidence in the “safe haven” narrative.

➤ Monetary Policy Divergence

While the Fed raises rates to fight inflation, many emerging economies are forced to keep rates low to avoid capital flight. This divergence makes dollar-denominated assets less attractive to foreign buyers.

1.3 The Rise of Dedollarization – A Global Movement

What began as a fringe idea among BRICS nations is now mainstream policy:

- China has been quietly accumulating gold since 2015, reporting 2,250+ tonnes as of Q1 2026.

- India added 75+ tonnes in 2025 alone, bringing total reserves to 800+ tonnes.

- Turkey has more than doubled its gold holdings since 2020.

- Poland became Europe’s top buyer in 2023, adding 130 tonnes to strengthen its buffer against NATO-related risks.

- Saudi Arabia is exploring pricing some oil exports in yuan—and may soon announce gold-backed trade settlements.

Even traditionally pro-dollar allies like Japan and South Korea have begun modestly increasing gold allocations to hedge against U.S. volatility.

This isn’t about rejecting the dollar entirely—it’s about building redundancy. As one Chinese official told Bloomberg: “We don’t want to bet everything on one horse.”

📈 Part 2: The Numbers Don’t Lie — Central Bank Gold Buying Is Accelerating

According to the World Gold Council (WGC), central bank demand for gold has surged since 2020:

| Year | Central Bank Gold Purchases (Tonnes) | % of Total Global Demand |

|---|---|---|

| 2020 | 390 | 22% |

| 2021 | 450 | 24% |

| 2022 | 1,136 | 40% |

| 2023 | 1,037 | 38% |

| 2024 | ~1,000 | 36% |

| 2025 | ~1,050 (est.) | 37% |

| 2026 (YTD) | On pace for >1,100 | Projected 40%+ |

Source: World Gold Council, Central Bank Gold Reserves Reports

Notably, emerging market central banks account for 85–90% of all purchases. Advanced economies like the U.S., Germany, and France have largely maintained stable holdings—or even sold small amounts.

Why the difference?

Because emerging economies face greater currency risk, political uncertainty, and exposure to sanctions. For them, gold isn’t optional—it’s essential.

🏦 Part 3: Who’s Leading the Charge? Top Central Banks Buying Gold

Let’s spotlight the biggest players driving this historic trend:

🇨🇳 China – The Silent Accumulator

China doesn’t report monthly gold purchases—only quarterly updates. But since 2015, it has quietly built its gold reserves from under 1,000 tonnes to over 2,250 tonnes as of early 2026.

Analysts estimate China may hold another 500–1,000 tonnes off-the-books, possibly stored domestically or through third-party custodians.

Its goal? Reduce reliance on the dollar, support the internationalization of the yuan, and prepare for potential financial decoupling with the West.

🇮🇳 India – Strategic Diversification

India’s gold reserves hit 800+ tonnes in 2025, making it the 10th-largest holder globally. With a young population, rising middle class, and persistent inflation, gold serves both as a cultural store of wealth and a macroeconomic stabilizer.

The RBI (Reserve Bank of India) has explicitly stated its intention to increase gold’s share in reserves to 15%+, up from 7% in 2020.

🇵🇱 Poland – Europe’s Surprise Buyer

Poland shocked markets in 2023 when it announced it had purchased 130 tonnes of gold in a single year—the largest annual purchase by any European nation since WWII.

Its rationale? To reduce exposure to Western financial systems amid heightened tensions with Russia and concerns about NATO cohesion.

🇹🇷 Turkey – Hedging Against Currency Collapse

Turkey’s lira has lost over 80% of its value against the dollar since 2018. In response, the Central Bank of Turkey has nearly tripled its gold reserves since 2020—to over 500 tonnes.

Gold acts as a lifeline during periods of hyperinflation and capital controls.

🇷🇺 Russia – Forced Into Self-Reliance

After losing access to $300B in reserves, Russia accelerated its gold accumulation, reaching 2,000+ tonnesbefore sanctions halted imports. It now uses gold to settle bilateral trade with China and India.

Russia’s playbook? Trade in gold, not dollars.

💰 Part 4: What This Means for Gold Prices and Markets

You might think: “Okay, central banks are buying gold. So what?”

Here’s what it means—for markets, for investors, and for your wallet.

4.1 Gold Prices Are Being Supported by Institutional Demand

While retail investors chase crypto or meme stocks, institutional buyers are quietly anchoring gold’s floor. Central bank purchases represent structural demand—not speculative trading.

This creates a powerful tailwind:

- Gold prices rose from $1,700/oz in 2020 to $2,300/oz in early 2026

- Analysts at JPMorgan and Goldman Sachs now project $2,500–$2,800/oz by end of 2026

- Some bullish forecasts (like those from Kitco and Sprott) see $3,000+ by 2027

Why? Because central banks aren’t selling. They’re accumulating—and they’re doing so with no exit strategy.

4.2 The Dollar Is Under Long-Term Pressure

Every ounce of gold bought by a central bank is one less dollar held in reserve.

Over time, this reduces global demand for U.S. Treasuries and weakens the dollar’s role in trade settlement.

Historical precedent shows that when reserve currencies lose dominance, their value declines. Think British pound after WWII. Think Japanese yen in the 1990s.

The dollar won’t collapse overnight—but its relative strength is fading. And that’s already showing up in currency markets:

- EUR/USD has risen steadily since 2023

- USD/CNY is testing multi-year lows

- Emerging market currencies (INR, TRY, BRL) are gaining resilience thanks to gold backing

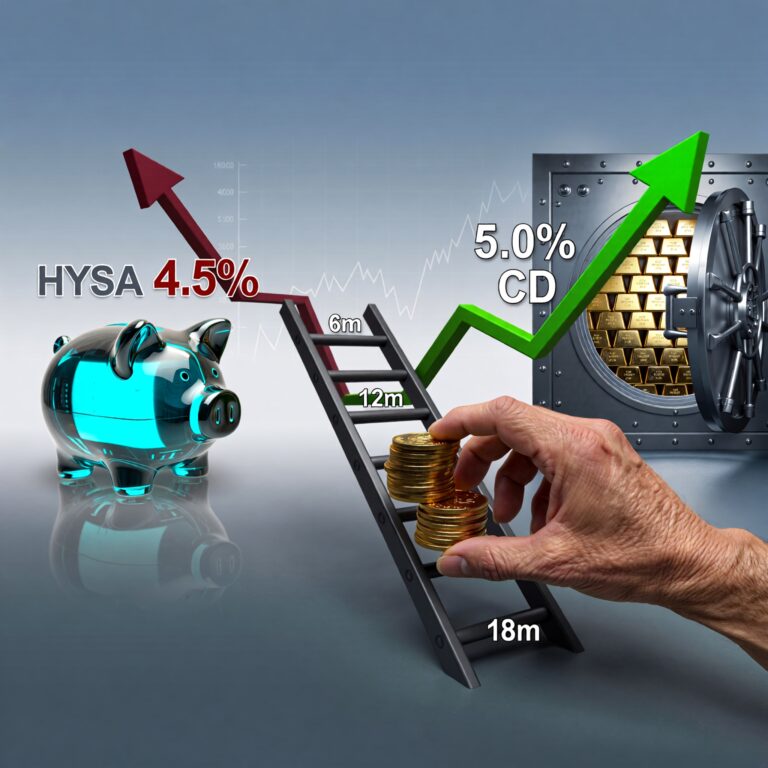

4.3 Opportunities for Investors

If central banks are hedging with gold, shouldn’t you?

Here’s how to position yourself:

✅ Physical Gold

Buy coins or bars from reputable dealers. Store securely. Ideal for long-term wealth preservation.

✅ Gold ETFs

GLD (SPDR Gold Shares), IAU (iShares Gold Trust) offer easy exposure without storage hassles.

✅ Gold Miners

GDX (VanEck Gold Miners ETF), GDXJ (Junior Gold Miners) provide leveraged upside during bull markets.

✅ Gold Streaming & Royalty Companies

Franco-Nevada (FNV), Wheaton Precious Metals (WPM) offer high-margin exposure with lower operational risk.

✅ Digital Gold Platforms

Platforms like Paxos Gold (PAXG) or Vaultoro allow tokenized ownership of real gold—ideal for tech-savvy investors.

🌐 Part 5: The Future of Money — Multipolarity, Not Monoculture

We are witnessing the dawn of a multipolar monetary system.

No longer will the world rely solely on the U.S. dollar. Instead, we’ll see:

- Regional currency blocs: Yuan-dominated Asia, Euro-focused EU, BRICS+ trade in local currencies

- Commodity-backed settlements: Oil traded for gold or yuan; grain settled in rubles or rupees

- Digital CBDCs: Central bank digital currencies designed to facilitate cross-border trade without SWIFT

- Gold as anchor: Not replacing fiat, but serving as the ultimate backstop for confidence

As Ray Dalio famously said:

“We are entering a period where multiple reserve currencies coexist—with gold playing a critical role.”

This isn’t about doom-and-gloom. It’s about realignment. About recognizing that trust must be earned—not assumed.

❓ Frequently Asked Questions (FAQ)

Q: Are central banks really buying gold to replace the dollar?

A: Not entirely. They’re diversifying away from over-reliance on the dollar. Gold provides insurance against systemic shocks, sanctions, and inflation.

Q: Will gold ever become the primary global reserve asset again?

A: Unlikely in the near term. But it’s becoming the preferred secondary reserve asset—especially for nations seeking autonomy.

Q: Should I buy gold now?

A: If you’re concerned about inflation, currency devaluation, or geopolitical instability, yes. Gold is a long-term hedge—not a get-rich-quick play.

Q: Can central banks sell gold if needed?

A: Technically yes—but politically, it’s extremely rare. Once accumulated, gold tends to stay in vaults indefinitely.

Q: How does this affect Bitcoin?

A: Both compete as “non-sovereign” stores of value. But gold has centuries of institutional adoption; Bitcoin offers speed and programmability. Many investors now hold both.

🧭 Final Thoughts: The Quiet Power of Gold in a Fractured World

“The dollar is losing credibility” isn’t hyperbole—it’s a sober assessment shared by central bankers, economists, and strategists worldwide.

And their response? Gold.

Not because it’s trendy. Not because it’s flashy. But because it’s reliable, neutral, and unbreakable.

As the world moves toward a multipolar financial order, gold is stepping into its most important role since Bretton Woods: the ultimate monetary anchor.

Whether you’re an investor, policymaker, or simply someone trying to protect your savings—you ignore this trend at your peril.

Because when central banks start buying gold like never before… it’s time to pay attention.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Gold prices can be volatile. Always conduct your own research and consult a qualified advisor before making investment decisions.

Read Also:

STOXX 600 Hits Record High Amid US Market Disruption: Europe’s Equity Renaissance in 2026

Fastest-Growing G20 Economies 2026: Where the Next Cycle Begins

One Comment