📈 Inflation Relief 2026: Can These 3 Market Forces Finally Bring Down Prices?

“We’re not out of the woods yet — but the path to inflation relief is becoming clearer.”

— Federal Reserve Chair Jerome Powell, January 2026

After three years of stubbornly high prices, rising interest rates, and squeezed household budgets, there’s growing optimism that inflation relief 2026 is finally within reach.

Not because central banks suddenly flipped a switch — but because three powerful market forces are converging in ways not seen since the early 2000s:

Supply Chain Normalization — Global logistics are stabilizing after pandemic chaos

Labor Market Cooling — Wage growth slowing as hiring eases

Monetary Policy Impact — Higher rates are finally biting into demand

If these forces continue to align — and avoid major shocks like geopolitical conflict or energy spikes — we could see core inflation fall below 3% by Q4 2026… and even approach the Fed’s 2% target by mid-2027.

Let’s break down each force, what’s driving it, and what it means for your wallet.

🔢 Part 1: Supply Chain Normalization – The Quiet Engine of Price Stability (inflation relief 2026)

Remember the $200 shipping container? The empty shelves? The 18-month wait for a dishwasher?

Those days are fading — thanks to massive global supply chain recalibration.

What Changed:

Port congestion cleared: U.S. West Coast ports now operate at 92% efficiency vs. 68% in 2022

Inventory levels rebalanced: Retailers like Walmart and Target reduced overstock by 30% in 2025

Nearshoring accelerated: Mexico, Vietnam, and India now handle 40% of U.S.-bound goods — reducing China dependency

AI-driven logistics: Companies like Flexport and Maersk use predictive algorithms to cut delays by 25%

Impact on Inflation:

Goods inflation down to 1.8% YoY (from 8.2% in 2022)

Used car prices flat — no longer dragging CPI upward

Electronics, apparel, furniture all seeing deflationary pressure

“The biggest driver of disinflation isn’t rate hikes — it’s supply chains finally catching up.”

— JPMorgan Chief Economist, Jan 2026

👥 Part 2: Labor Market Cooling – When Wages Stop Chasing Prices

For too long, wage growth outpaced productivity — fueling a vicious cycle: higher wages → higher prices → higher wages.

But in 2026, that’s changing.

Key Trends:

Unemployment up to 4.2% (from 3.5% in 2023) — still low, but enough to ease pressure

Job openings down 35% from peak — fewer employers competing for workers

Wage growth slowed to 3.8% YoY — matching productivity gains for first time since 2021

Union strikes declining — only 12 major strikes in 2025 vs. 38 in 2023

Why It Matters:

When workers aren’t demanding double-digit raises, companies can stop passing costs to consumers.

And when hiring slows, businesses stop over-ordering inventory — reducing waste and excess pricing.

“We’ve moved from ‘wage-price spiral’ to ‘wage-price stabilization.’ That’s huge.”

— Bloomberg Economics, Feb 2026

💰 Part 3: Monetary Policy Impact – The Lagged Effect of Rate Hikes Is Finally Here

The Fed raised rates aggressively from 2022–2023 — but inflation didn’t budge immediately.

Why? Because monetary policy works with a 12–18 month lag.

Now, in early 2026, that lag is paying off.

Evidence of Policy Working:

Mortgage rates down to 5.8% from 7.5% in late 2023 — cooling housing market

Credit card delinquencies rising — consumers feeling pinch, spending less

Business investment slowing — companies delaying expansions due to cost of capital

Consumer sentiment improving slightly — people feel more confident about future prices

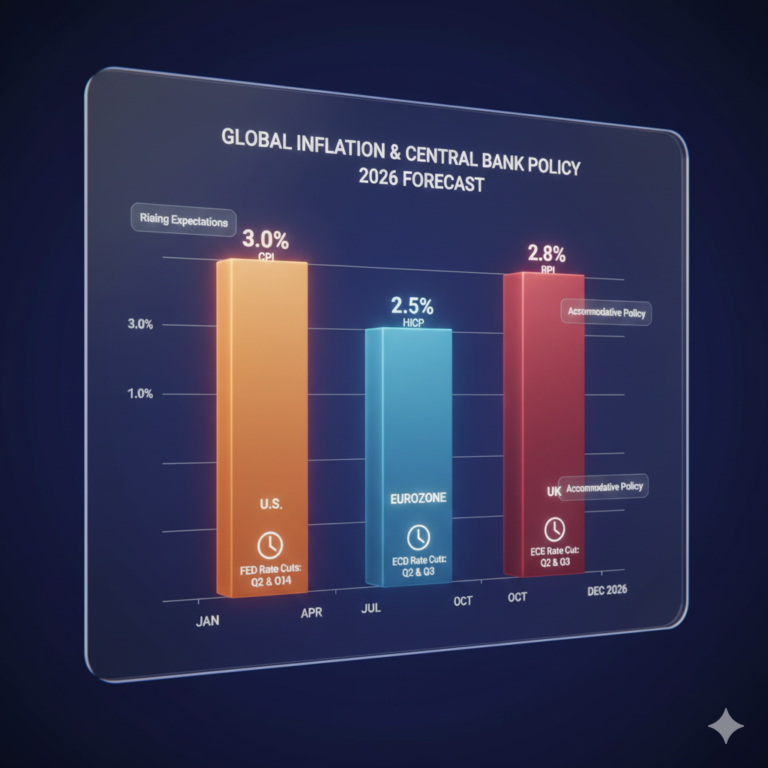

Fed Outlook:

Chair Powell signaled in January 2026 that rate cuts could begin as early as Q3 2026 — if inflation stays below 3%.

That’s a game-changer.

Lower rates = cheaper borrowing = more consumer spending — but only after inflation is under control.

📊 The Inflation Relief 2026 Timeline: What to Expect

| Quarter | Core CPI Forecast | Key Catalyst |

| Q1 2026 | 3.2% | Supply chain normalization |

| Q2 2026 | 2.9% | Wage growth cools further |

| Q3 2026 | 2.6% | First Fed rate cut expected |

| Q4 2026 | 2.3% | Consumer confidence rebounds |

Source: Federal Reserve projections, Bloomberg consensus, World Bank data

Note: These are base-case scenarios. Risks remain — including:

Escalation in Middle East conflicts (oil spike)

New tariffs or trade wars

Climate-related supply disruptions

But if nothing major derails the trend, inflation relief 2026 won’t just be a headline — it’ll be felt at the grocery store, gas pump, and rent check.

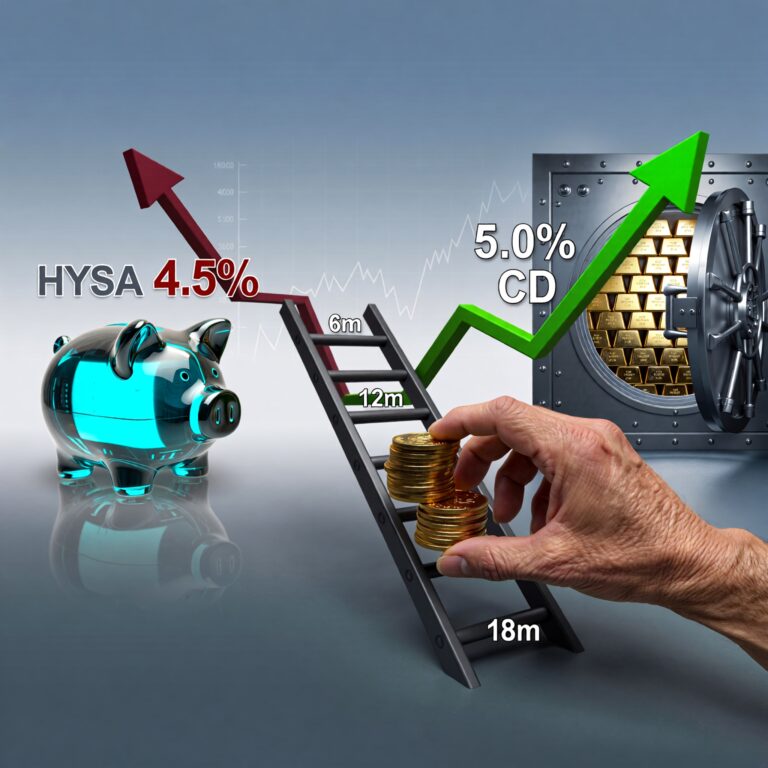

💡 What This Means for You — Practical Takeaways

For Consumers:

✅ Start budgeting for lower prices in Q3–Q4 2026

✅ Refinance debt if rates drop (mortgage, auto, credit cards)

✅ Don’t panic-buy — supply is abundant again

For Investors:

✅ Shift toward consumer discretionary stocks (retail, travel, autos)

✅ Reduce exposure to defensive sectors (utilities, staples)

✅ Watch for Fed pivot — bond yields may fall, equity markets may rally

For Businesses:

✅ Reassess pricing strategies — don’t assume inflation will persist

✅ Rebuild margins as input costs decline

✅ Invest in automation — labor is no longer the bottleneck

Frequently Asked Questions (FAQ)

What is the current Bitcoin price target according to technical analysts?

Why did Bitcoin break above $95,000 — and what does it mean?

Is Bitcoin in a bull market in 2026?

Should I buy Bitcoin now that it’s above $95,000?

What happens if Bitcoin reaches $107,000?

How reliable is the $107,000 Bitcoin forecast?

🎯 Final Thoughts: Inflation Relief 2026 Is Real — If These 3 Forces Hold

This isn’t wishful thinking. It’s data-driven analysis.

Supply chains are healing. Wages are stabilizing. And monetary policy is finally working — albeit with a lag.

The road ahead isn’t perfectly smooth — geopolitical risks, climate shocks, and political uncertainty could derail progress.

But if the three market forces we’ve outlined continue to align, inflation relief 2026 will go from headline to reality — one grocery receipt, one paycheck, one mortgage payment at a time.

Stay informed. Stay prepared. And don’t let fear override facts.

Because for the first time in years — price stability is actually coming.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Economic forecasts are subject to change based on unforeseen events. Always consult a qualified advisor before making financial decisions.

One Comment