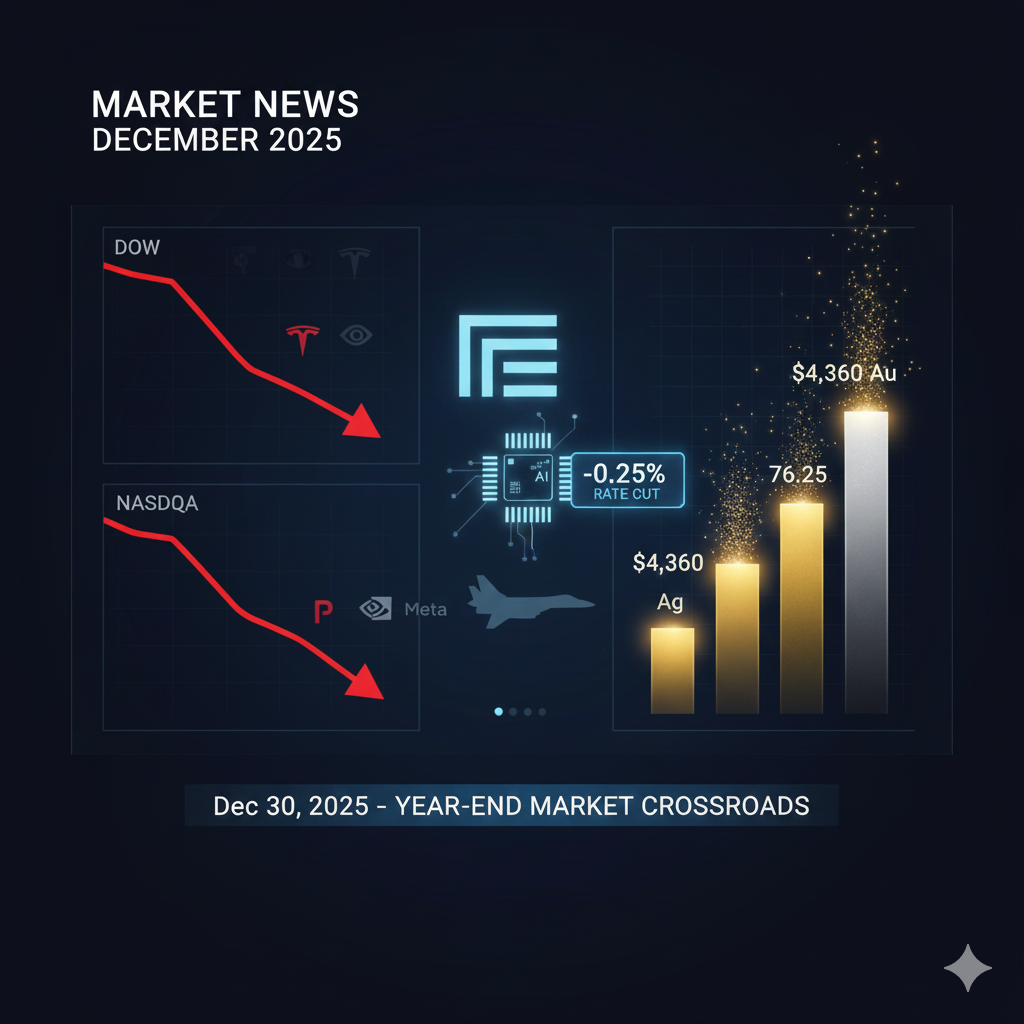

Market News December 2025: Stocks Dip, Gold Soars, Fed Signals Cuts

As 2025 drew to a close,(Market News December 2025) U.S. financial markets reflected a year of extreme contrasts: AI-driven tech rallies, surging precious metals, aggressive Fed policy shifts, and growing anxiety about the labor market. The final trading days of December painted a nuanced picture—cautious equities, soaring gold, and a central bank preparing for 2026 cuts.

Here’s a detailed breakdown of the key developments—and what they mean for your financial strategy heading into the new year.

📉 Equities End 2025 on a Quiet, Slightly Negative Note

For the third straight session, major U.S. indexes closed lower on December 30, 2025:

- Dow Jones: –0.2%

- S&P 500: –0.1%

- Nasdaq: –0.2%

The pullback wasn’t driven by panic—but by profit-taking and macro uncertainty. Notably, tech giants underperformed:

- Tesla (–1.2%) on weak Q4 delivery forecasts (expected 422K vehicles, down 15% YoY)

- Palantir (–1.8%) amid concerns over AI capex sustainability

- Nvidia (–0.4%), despite completing a $5B strategic investment in Intel

Yet, defensive and industrial names held strong:

- Boeing (+0.6%) surged after winning an $8.58B Pentagon contract to build F-15 fighter jets for Israel

- Energy sector (+0.8%) led the S&P 500, with Occidental Petroleum (+2.6%) on rising oil volatility

🏦 Fed Minutes Reveal Deepening Dovish Shift (Market News December 2025)

The December FOMC meeting minutes, released on December 30, confirmed a pivotal shift:

“Several officials saw greater risk in a deteriorating labor market than in sticky inflation.”

This marked the third consecutive rate cut—and signaled that more cuts are likely in 2026 if unemployment continues rising (it hit 4.3% in late December, triggering the Sahm Rule).

However, the Fed remains cautious: (Market News December 2025):

“Some participants suggested keeping rates unchanged for some time after this cut.”

Translation: The era of “higher for longer” is over—but the Fed won’t rush into aggressive easing.

This nuance explains why the 10-year Treasury yield ticked up to 4.13%—investors are pricing in modest, data-dependent cuts, not emergency stimulus.

🥇 Gold and Silver Stage Historic Year-End Rally

2025 was a banner year for precious metals:

- Gold surged 65%, hitting an all-time high of $4,560/oz before pulling back

- On December 30, it rebounded to $4,360/oz after a margin-induced selloff

- Silver exploded 8% to $76.25/oz, reversing a 6.5% drop the day before

Why? Three drivers:

- Geopolitical risk (Middle East tensions, global elections)

- Recession fears (ISM manufacturing in 14-month slump)

- Dollar weakness (U.S. dollar index at 98.24)

Analysts expect gold to remain elevated in 2026—especially if the Fed cuts rates and global growth stalls.

🤖 AI Reshapes the Labor Market—Especially for Graduates

Beyond markets (Market News December 2025), a quieter revolution unfolded in employment:

- AI is replacing entry-level roles in coding, research, and customer service

- Graduate school applications surged in counseling, law, and mental health—fields less automatable

- The Bureau of Labor Statistics projects high demand for substance abuse and career counselors through 2030

This shift reflects a “low-hire, low-fire” labor market, where companies automate instead of hiring—and workers seek recession-proof credentials.(Market News December 2025)

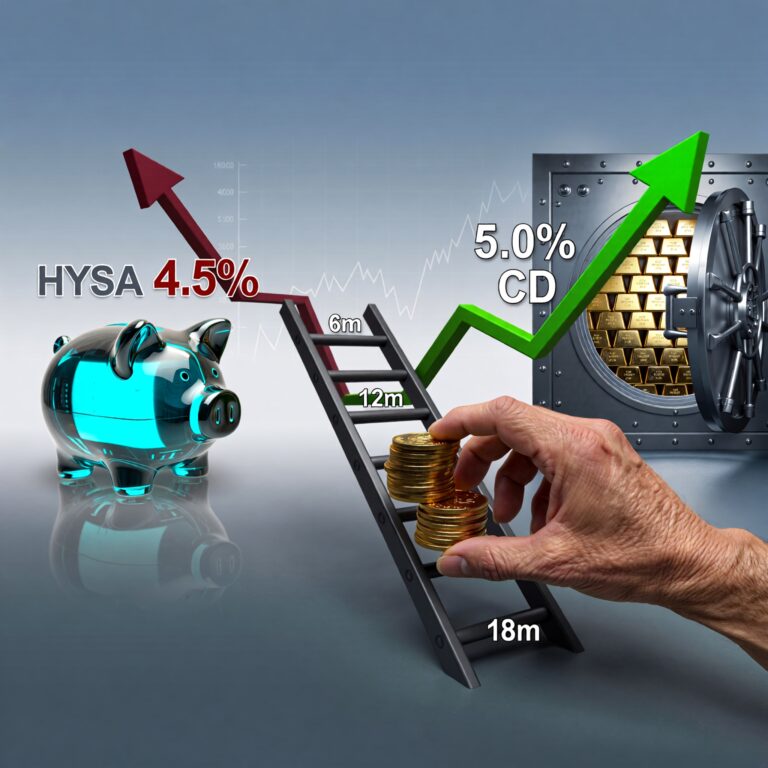

💳 What This Means for Your 2026 Financial Plan

- Lock in high-yield CDs now—rates may fall if the Fed cuts in Q1

- Hold gold as a hedge—60/40 portfolios may underperform in volatile 2026

- Audit AI tool spending—not all AI delivers ROI (use Yieldoom’s AI Tools ROI Calculator)

- Build a 6–9 month emergency fund—job security is no longer guaranteed, even in tech

📅 Looking Ahead: Key Dates for Early 2026

- January 3: Social Security COLA payments (+2.8%) begin

- January 9: December Jobs Report (Sahm Rule confirmation)

- January 28: Fed’s first 2026 meeting (no cut expected, but guidance critical)

🔚 Final Takeaway (Market News December 2025):

December 2025 wasn’t just a year-end wrap—it was a pivot point. The Fed has shifted from inflation fighter to recession watchdog. Markets are pricing in slower growth. And individuals are adapting—through asset allocation, career choices, and cost-conscious tech adoption.

In 2026, agility beats prediction. Stay data-driven. Stay prepared. (Market News December 2025)

Disclaimer: This is not financial advice. Past performance is not indicative of future results. Consult a qualified advisor before making financial decisions.