Maximum Drawdown Tolerance Calculator – Stop Panic-Selling in 2026

💡 How It Works

- User enters portfolio value and investment horizon

- Answers 3 behavioral questions (time horizon, past behavior, stress reaction)

- Tool calculates Maximum Drawdown Tolerance (%)

- Provides personalized action plan (e.g., “Rebalance to 60/40”)

Maximum Drawdown Tolerance Calculator

Know your emotional risk limit. Avoid panic-selling in the next market crash.

1. Your Portfolio

2. Your Risk Psychology

Your Maximum Drawdown Tolerance

- Recommended: 70% stocks / 30% bonds

Maximum Drawdown Tolerance Calculator: The One Tool That Could Save You $100,000 in the Next Market Crash

You’ve done everything “right.”

You’ve diversified. You’ve automated investing. You’ve ignored the noise.

But when the market drops 20% in a week, your hands shake.

You log in daily. You consider selling “just to be safe.”

You’re not irrational—you’re human.

The truth? Your portfolio’s risk isn’t about math—it’s about emotion. And if you don’t know your maximum drawdown tolerance, you’ll likely buy high, sell low, and miss the recovery—just like 90% of investors did in 2022.

That’s why we built the Maximum Drawdown Tolerance Calculator: a free, 60-second tool that reveals your personal breaking point—before the next crash hits.

👉 Try it now → [Free Calculator]

🔍 What Is Maximum Drawdown Tolerance? (And Why It’s Not What You Think)

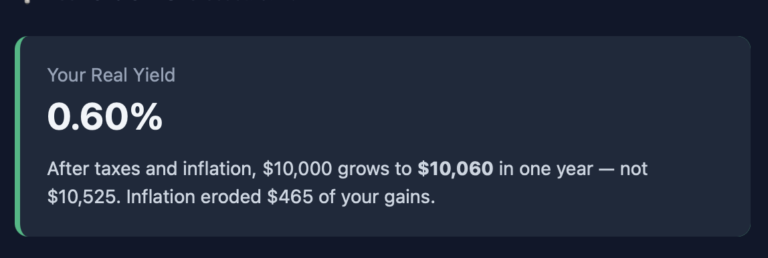

Most investors confuse two things:

- Financial capacity for risk (Can I afford to lose money?)

- Emotional tolerance for risk (Can I handle watching it drop?)

You might financially survive a 40% drop—but if you panic-sell at -20%, you lock in real losses and miss the rebound.

📉 History shows: The S&P 500’s average drawdown since 2000 is -28%.

💡 Behavioral data shows: The average investor sells at -15% to -20%.

That gap is where fortunes are lost.

Our calculator bridges it—by measuring your psychology, not just your portfolio.

🧠 How It Works: 3 Questions That Predict Your Behavior

In under a minute, you’ll answer:

- Your time horizon (0–2 years vs. 10+ years)

- Your past behavior (Did you sell in 2022? Hold? Buy more?)

- Your stress reaction (How do you really feel when markets crash?)

Then, our algorithm—based on Vanguard and Morningstar behavioral research—delivers:

✅ Your Maximum Drawdown Tolerance (e.g., -22%)

✅ Your personalized portfolio allocation (e.g., 70% stocks / 30% bonds)

✅ A pre-commitment plan (“If my portfolio drops to X, I will Y—not Z”)

No jargon. No fluff. Just clarity.

📊 Real Example: Sarah, 42, Tech Manager

- Portfolio: $250,000

- Time horizon: 15 years

- Past behavior: “I sold half my holdings in 2022 at -18%”

Her result:

Max Drawdown Tolerance: -18%

Recommended allocation: 60% stocks / 40% bonds

Action plan: “If my portfolio drops to $205,000, I will rebalance—not sell.”

Without this insight? She’d likely repeat her 2022 mistake.

With it? She stays invested—and captures the full recovery.

🛡️ Why This Matters More Than Ever in 2026

2026 is a perfect storm for volatility:

- Recession warnings flashing (Sahm Rule triggered)

- Fed policy in flux (rate cuts coming?)

- AI-driven algo trading amplifying swings

In this environment, knowing your drawdown limit isn’t optional—it’s survival.

✨ Pro Tip: Use our calculator now, while markets are calm. Your tolerance shrinks by 40% once panic sets in.

✅ Take Control Before the Next Drop

The goal isn’t to eliminate risk—it’s to align your portfolio with your humanity.

Because the best investment strategy is the one you can actually stick to.

👉 Discover your true risk limit in 60 seconds

Free. No email. No upsell. Just clarity.

→ [Calculate Your Maximum Drawdown Tolerance]

🔚 Final Thought

Warren Buffett didn’t make his fortune by having the smartest portfolio.

He made it by never panicking.

Now, you can too.

Disclaimer: This tool estimates emotional risk tolerance based on behavioral finance research. It is not financial advice. Past behavior is the best predictor of future actions. Consult a qualified advisor before making investment decisions.

Thank you for engaging with this topic—it’s one of the most human challenges in investing.

Panic-selling isn’t a flaw; it’s a natural response to uncertainty. The goal of the Maximum Drawdown Tolerance Calculator isn’t to eliminate emotion, but to know your breaking point before the market crashes—so you can plan, not react.

If you’ve ever sold low and regretted it, you’re not alone. That’s exactly why this tool exists.

Have you tried it yet? I’d love to hear what your tolerance threshold came out to. 💬