STOXX 600 Hits Record High Amid US Market Disruption: Europe’s Equity Renaissance in 2026

In January 2026, a quiet but seismic shift unfolded in global financial markets: the STOXX Europe 600 Index—the broadest benchmark of European equities—surged past its previous all-time high to reach 538.7 points, marking a watershed moment for a region long overshadowed by U.S. market dominance. This milestone didn’t occur in isolation. It emerged against a backdrop of mounting “U.S. disruption”—a term now widely used by institutional strategists to describe the confluence of political volatility, valuation extremes, regulatory overhangs, and fiscal imbalances plaguing American markets.

For over a decade, investors poured capital into U.S. tech giants, chasing momentum and innovation. But as 2026 unfolds, that narrative is fracturing. Capital is rotating—not just tactically, but structurally—toward Europe. And the STOXX 600 record high may be the first definitive signal of a new era: one where Europe reclaims its role as a core pillar of global portfolio construction.

(STOXX 600 record high) This comprehensive analysis explores:

The macroeconomic and geopolitical forces behind the rally

A detailed sector-by-sector breakdown of outperformers

Historical context: How this compares to past European bull markets

Investor behavior shifts among institutions, hedge funds, and retail

Risks that could derail the momentum

Actionable strategies for capturing opportunity in European equities

Whether you’re an institutional allocator, a retail investor, or a financial content creator building authority in market trends, understanding this inflection point is essential for navigating the rest of 2026 and beyond.

Part I: Understanding the STOXX 600 — Europe’s Economic Barometer

Before diving into the rally, it’s critical to understand what the STOXX Europe 600 actually represents.

Launched in 1998 by STOXX Ltd. (a joint venture originally involving Deutsche Börse, SIX Group, and others), the index tracks 600 large-, mid-, and small-cap companies across 17 European countries, including major economies like Germany, France, the UK, Switzerland, and the Nordic bloc. Unlike the Euro Stoxx 50—which focuses only on eurozone blue chips—the STOXX 600 offers true pan-European exposure, with sectors weighted by free-float market capitalization.

Key characteristics:

Sector diversity: No single sector exceeds 20% of the index

Geographic balance: ~40% Eurozone, ~25% UK, ~20% Switzerland/Sweden/Denmark, ~15% others

Representative breadth: Covers ~90% of Europe’s investable market cap

Because of this structure, the STOXX 600 is often viewed as the most accurate proxy for the health of the European economy—far more so than narrow indices dominated by banks or energy firms.

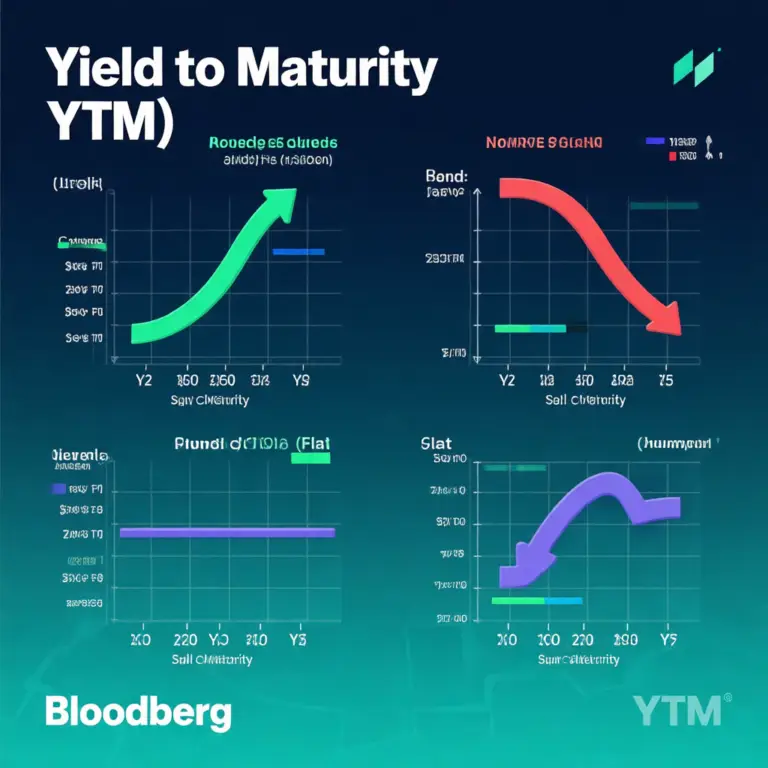

Historically, the index has lagged U.S. benchmarks. From 2010 to 2024, the S&P 500 delivered annualized returns of ~14%, while the STOXX 600 returned just ~6%. But that gap is now closing—and possibly reversing.

Part II: What Is “US Disruption”? Decoding the Catalyst Behind Capital Flight

The phrase “U.S. disruption” has gained prominence in 2025–2026 investment circles. It doesn’t refer to a single event, but rather a multi-layered crisis of confidence in the sustainability of U.S. market leadership. Let’s unpack its components.

- Valuation Extremes and Concentration Risk

The S&P 500’s performance since 2020 has been driven overwhelmingly by a handful of mega-cap tech stocks—often dubbed the “Magnificent Seven.” As of Q4 2025:

These seven firms accounted for over 30% of the S&P 500’s total market cap

The Nasdaq 100 traded at a forward P/E of 32x, versus a 20-year average of 22x

Price-to-sales ratios in AI-related software names exceeded 20x—levels last seen during the dot-com bubble

This concentration creates fragility. Any earnings miss, regulatory action, or sentiment shift can trigger outsized corrections. In contrast, the STOXX 600’s top 10 holdings represent only ~15% of the index, offering natural diversification.

- Political and Policy Uncertainty

The 2026 U.S. election cycle has intensified polarization. Key concerns include:

Potential rollback of climate and tech regulations depending on the outcome

Fiscal irresponsibility: U.S. federal debt now exceeds 130% of GDP, with no bipartisan plan for stabilization

Trade policy volatility: Renewed threats of tariffs on EU goods (e.g., steel, autos, green tech)

Such uncertainty makes long-term planning difficult for multinational corporations and institutional investors alike.

- Regulatory Crackdowns on Big Tech and AI

The U.S. Department of Justice and FTC have escalated antitrust actions against dominant tech platforms. Simultaneously, Congress is debating sweeping AI legislation that could restrict data usage, model training, and monetization—posing existential risks to business models built on scale and network effects.

Europe, meanwhile, has already implemented its regulatory framework (e.g., Digital Markets Act, AI Act). While initially seen as restrictive, these rules now provide regulatory clarity—a rare commodity in today’s markets.

- Dollar Volatility and De-Dollarization Trends

The U.S. dollar, long the world’s reserve currency, is facing structural headwinds:

Central banks are diversifying reserves into euros, gold, and even digital assets

BRICS+ nations are expanding local-currency trade settlements

Persistent U.S. current account deficits undermine long-term confidence

A weaker dollar boosts returns for non-U.S. assets when converted back into dollars—making European equities doubly attractive.

Result: Global asset allocators are reducing U.S. equity exposure from historical highs (often 60–70% of portfolios) toward a more balanced 40–50% allocation, with the difference flowing into Europe, Japan, and select emerging markets.

Part III: Why Europe? The Four Pillars of the STOXX 600 Rally

Europe’s resurgence isn’t just about U.S. weakness—it’s also about European strength. Four interlocking pillars are driving the STOXX 600 record high:

Pillar 1: Macroeconomic Stabilization

After years of stagnation, Europe’s macro picture has brightened significantly:

Inflation: Down to 2.1% in December 2025 (from 10.6% peak in 2022), nearing the ECB’s 2% target

Growth: Q4 2025 GDP surprised to the upside at +0.4% q/q, driven by services and manufacturing rebound

Labor markets: Unemployment at 6.2%—a multi-decade low—with wage growth moderating to sustainable levels (~3.5%)

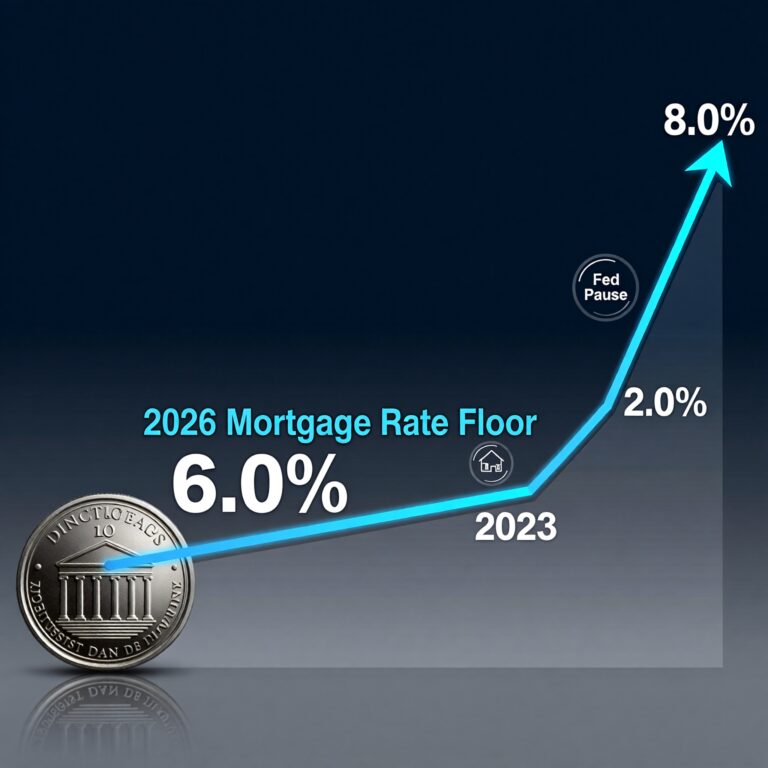

The European Central Bank (ECB), having front-loaded rate hikes in 2022–2023, is now in a position to cut rates in mid-2026, providing a tailwind for risk assets—unlike the Fed, which remains data-dependent and hawkish.

Pillar 2: Corporate Profit Rebound

European corporate earnings, long criticized for underperformance, are staging a comeback:

Q4 2025 EPS growth: +8.3% year-over-year (vs. +5.1% for S&P 500)

Margin expansion: Driven by cost discipline, automation, and pricing power in niche industrial segments

Capital return: Share buybacks in Europe hit €85 billion in 2025—a record—signaling confidence and shareholder friendliness

Notably, European firms are less reliant on speculative future earnings; they generate stronger free cash flow yields (average: 4.2% vs. 2.8% in the U.S.), appealing to value-oriented investors.

Pillar 3: Strategic Autonomy and Industrial Policy

The EU has shifted from passive regulation to active industrial strategy:

Green Deal Industrial Plan: €1 trillion committed to clean tech, hydrogen, and battery supply chains

Chips Act: €43 billion to boost semiconductor sovereignty

Defense Investment Package: Member states increasing military spending post-Ukraine, benefiting aerospace and cybersecurity firms

These initiatives are creating new growth vectors beyond traditional sectors—mirroring U.S. IRA (Inflation Reduction Act) benefits but with less fiscal strain.

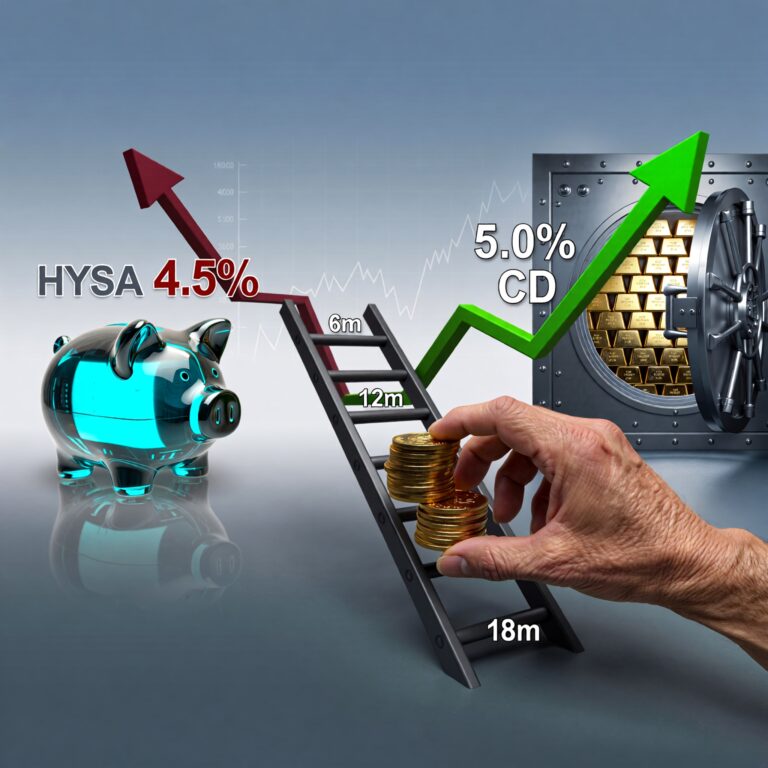

Pillar 4: Attractive Valuations and Yield Appeal

As of January 2026:

STOXX 600 forward P/E: 14.1x

Dividend yield: 3.4% (vs. S&P 500’s 1.5%)

Price-to-book: 1.6x (vs. S&P 500’s 4.3x)

This combination of growth, income, and margin of safety is drawing income-focused funds, pension plans, and conservative allocators back to Europe after a decade-long absence.

Part IV: Sector Deep Dive — Who’s Leading the Charge?

The STOXX 600’s rally is broad-based, but certain sectors are outperforming decisively. Here’s a breakdown:

- Financials (18% of index)

European banks are enjoying a “Goldilocks” scenario:

Net interest margins stabilized after ECB rate hikes

Loan demand recovering in SME and mortgage segments

Strong capital buffers (CET1 ratios >15%) allowing increased dividends

Top performers: HSBC (UK), BNP Paribas (France), ING Groep (Netherlands)

- Industrials (15%)

Benefiting from onshoring, defense spending, and infrastructure renewal:

Siemens (Germany): Leading in factory automation and grid tech

Rolls-Royce (UK): Small modular nuclear reactors gaining traction

ABB (Switzerland): Robotics and electrification solutions in high demand

- Healthcare (13%)

Resilient and innovation-driven:

Novo Nordisk (Denmark): GLP-1 drugs (e.g., Wegovy) seeing explosive global uptake

Roche (Switzerland): Oncology pipeline advancing with AI-assisted drug discovery

Sanofi (France): Vaccines and rare disease treatments providing steady cash flow

- Basic Resources & Energy (12%)

Despite ESG pressures, select commodities are in structural deficit:

Rio Tinto (UK): Critical minerals (copper, lithium) for energy transition

TotalEnergies (France): Balanced portfolio of oil, gas, and renewables

Vonovia (Germany): Residential real estate as an inflation hedge

- Technology (8%) – The Quiet Ascent

Often overlooked, Europe’s tech sector is growing steadily:

ASML (Netherlands): Monopoly on EUV lithography machines—essential for advanced chips

SAP (Germany): Cloud ERP adoption accelerating globally

Adyen (Netherlands): Fintech payments platform expanding in U.S. and Asia

While smaller than U.S. tech, European tech offers lower valuations and clearer paths to profitability.

Part V: Historical Context — How Does This Rally Compare?

To assess sustainability, we must look back.

The 2000 Dot-Com Bubble Aftermath

Post-2000, European equities briefly outperformed as U.S. tech collapsed. But lack of reform and banking fragility led to underperformance through the 2008 crisis.

The 2010s: Lost Decade

Austerity, Brexit, and the eurozone debt crisis suppressed European markets. The STOXX 600 didn’t recover its 2007 peak until 2018.

The 2020–2024 Lag

Pandemic recovery was slower in Europe due to fragmented fiscal response and energy shocks from the Ukraine war.

Why 2026 Is Different

This time, Europe enters the rally with:

Stronger bank balance sheets

Unified fiscal tools (NextGenerationEU recovery fund)

Pro-growth industrial policy

Lower dependence on Russian energy

Analysts at Goldman Sachs argue this could be the start of a “European Quality Cycle”—similar to Japan’s post-2012 re-rating—where consistent ROE improvement drives multiple expansion.

Part VI: Investor Behavior — Who’s Buying and Why?

Institutional Investors

Pension funds (e.g., APG, Norges Bank) are increasing European allocations from 15% to 25% of equity sleeves, citing:

Liability-matching via dividend income

ESG alignment (EU taxonomy is global gold standard)

Reduced correlation to U.S. tech volatility

Hedge Funds

Quant and macro funds are executing relative value trades: short U.S. tech, long European cyclicals. Notable names like Marshall Wace and Man Group have launched dedicated European alpha strategies.

Retail Investors

Platforms like Trading 212 and Interactive Brokers report surging demand for:

STOXX 600 ETFs (e.g., EXX1, SXR8)

Thematic funds (clean energy, healthcare innovation)

Dividend aristocrats (e.g., Novartis, Allianz)

Even U.S. retail investors are accessing Europe via low-cost ETFs—recognizing the diversification benefit.

Part VII: Risks That Could Derail the Rally

Despite the optimism, several risks warrant caution:

- Geopolitical Flashpoints

Escalation in Ukraine or NATO tensions

China-EU trade disputes (e.g., EV tariffs)

Middle East instability impacting energy flows

- Slower AI Adoption

Europe lags in generative AI deployment. Without rapid catch-up, productivity gains may disappoint, capping long-term growth.

- Fragmented Fiscal Union

Unlike the U.S., Europe lacks a unified treasury. During crises, this can lead to divergent bond yields (e.g., Italy vs. Germany), undermining cohesion.

- Climate Transition Costs

Heavy industry decarbonization is expensive. Carbon border taxes (CBAM) may protect EU firms but invite retaliation.

However, many of these risks are already priced in. The STOXX 600’s volatility (30-day realized vol: 12%) remains below its 10-year average—suggesting calm, not euphoria.

Part VIII: Investment Strategies for Capturing the Opportunity

How can investors participate wisely?

- Core Exposure: Low-Cost ETFs

iShares Core STOXX Europe 600 (EXX1) – Accumulating, TER: 0.10%

SPDR MSCI Europe Quality Mix ETF – Focus on high-ROE, low-debt firms

Vanguard FTSE Developed Europe UCITS – Broad, dividend-focused

- Thematic Plays

Clean Energy: iClima European Green 50

Healthcare Innovation: HANetf S&P Europe Health Care ETF

Digital Transformation: WisdomTree Artificial Intelligence & Innovation

- Active Management

Consider active European equity funds with proven stock-picking ability:

Lindsell Train European Fund

T. Rowe Price European Equity

Fidelity European Growth

- Currency Hedging Considerations

For U.S.-based investors, unhedged exposure benefits from potential euro appreciation. But if the Fed cuts before the ECB, hedging may be prudent.

Part IX: Forward Outlook — Scenarios for the Rest of 2026

We model three potential paths:

Base Case (60% probability): Gradual Outperformance

STOXX 600 reaches 570–590 by year-end

U.S. markets flat as earnings adjust to higher rates

Europe gains 2–3% market share in global equity allocations

Bull Case (25%): Full Rotation Cycle

U.S. recession triggers massive capital reallocation

STOXX 600 hits 620+, dividend yields compress to 3.0%

European tech IPOs surge (e.g., Klarna, Revolut)

Bear Case (15%): Rally Fizzles

U.S. avoids recession, tech rebounds strongly

Europe faces energy shock or political fragmentation

STOXX 600 retests 500 support

Most strategists favor the base case, viewing this as the start of a multi-year re-rating—not a short squeeze.

Conclusion: A New Chapter for European Equities

The STOXX 600 record high amid U.S. disruption is more than a headline—it’s a signal of tectonic shifts in global finance. Europe is no longer the “old economy” laggard. It’s a diversified, cash-generative, policy-supported market offering compelling value in an overextended world.

For investors who’ve ignored Europe for years, the message is clear: it’s time to reassess. Whether through ETFs, thematic funds, or individual securities, strategic exposure to European equities can enhance returns, reduce portfolio volatility, and provide a hedge against U.S.-centric risks.

As the global investment playbook evolves in 2026, one thing is certain: Europe is back on the map—and the STOXX 600 is leading the way.

Read More: Fastest-Growing G20 Economies 2026: Where the Next Cycle Begins

One Comment